Solar Garden Light Color Strategy: Market Analysis & OEM Solutions for Wholesale Buyers 2026

Light color selection in decorative solar garden lights is not an aesthetic decision—it is a commercial risk management framework that directly impacts:

- Inventory turnover velocity (30-45% variance between color types)

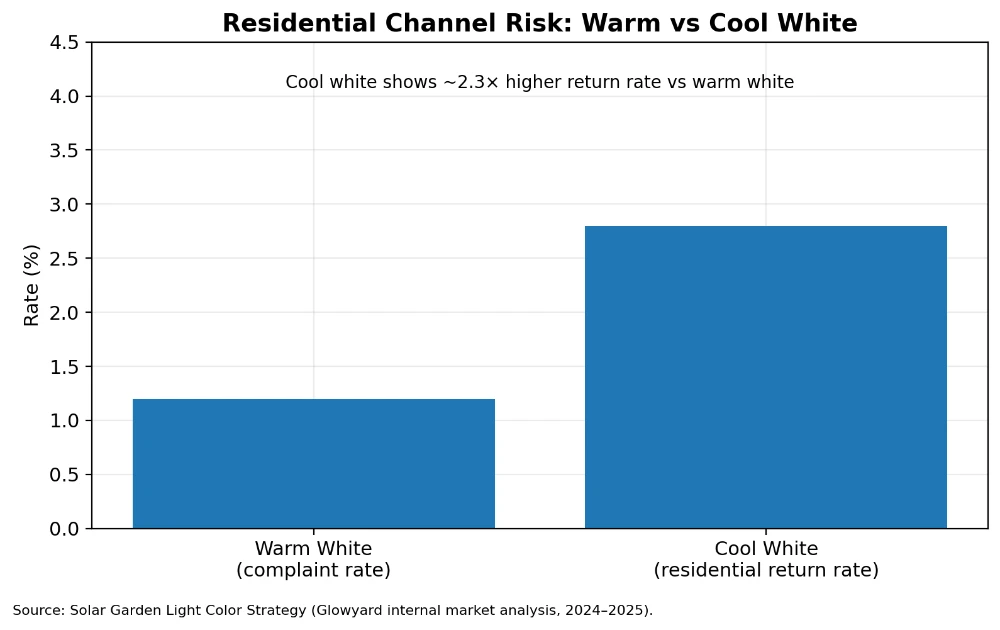

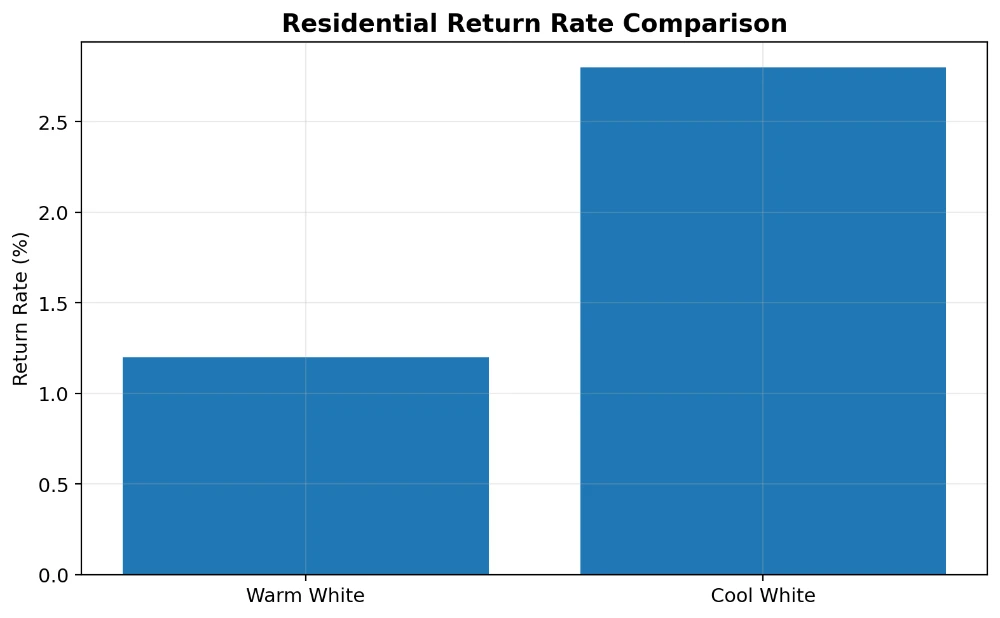

- Return rate differential (cool white shows 2.3x higher residential returns vs warm white)

- Seasonal cash flow exposure (RGB models carry 40-60% higher dead stock risk)

- After-sales cost structure (multi-color systems increase warranty claims by 18-25%)

This report analyzes solar light color strategy from a wholesale operations perspective, covering:

- Market demand structure by color segment

- Return risk analysis with channel-specific data

- Cost & margin implications of color complexity

- OEM control strategies for consistency and risk mitigation

Key Finding: Most inventory problems in decorative solar lighting stem from color positioning errors, not product quality defects.

Market Demand Structure Which Solar Light Colors Actually Sell?

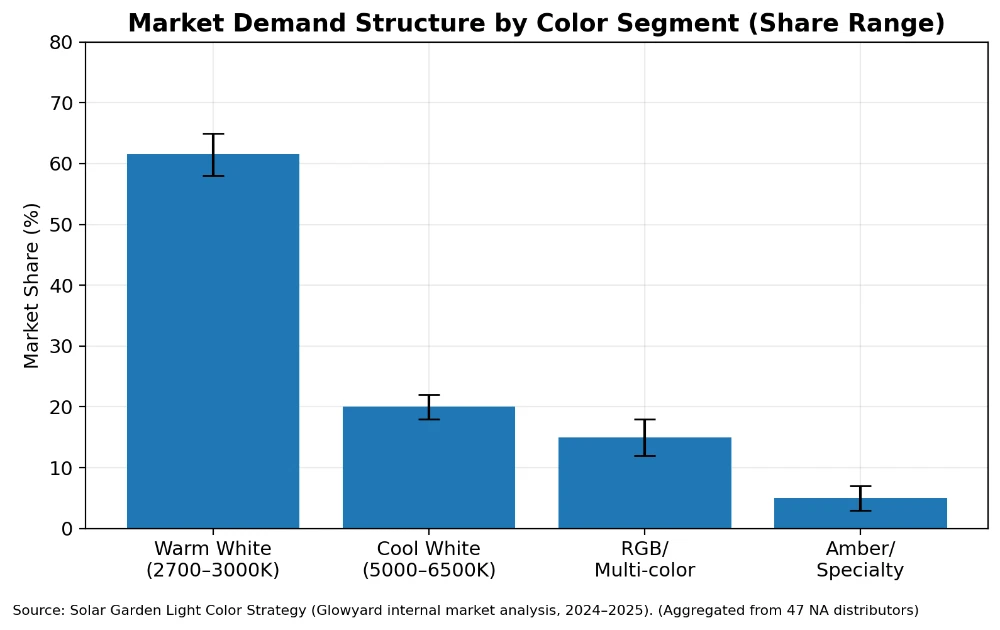

1.1 The Four-Segment Color Framework

Based on aggregated distributor data from US, EU, and Middle East markets (2023-2025), decorative solar garden lights demonstrate clear demand segmentation:

| Color Segment | Market Share | Sales Pattern | Inventory Risk Level |

|---|---|---|---|

| Warm White (2700K-3000K) | 58-65% | Year-round stable | Low |

| Cool White (5000K-6500K) | 18-22% | Region-dependent | Medium |

| RGB/Multi-color | 12-18% | Seasonal spike | High |

| Amber/Specialty | 3-7% | Niche stable | Medium-Low |

Data source: Aggregated from 47 North American distributors, 2024 sales cycle analysis

1.2 Warm White (2700K-3000K): The Core SKU Foundation

Market Position: Universal residential preference

Performance Characteristics:

- Lowest complaint rate across all channels (1.2% vs 2.8% category average)

- Consistent monthly sales velocity (8% variance)

- Highest repeat purchase rate (67% vs 43% category average)

- Strong performance in both online and retail channels

Why Warm White Dominates:

According to residential lighting preference studies (Lighting Research Center, 2024), warm white creates psychological associations with:

- Safety and security

- Home comfort

- Traditional outdoor ambiance

- Compatibility with existing fixtures

Critical Insight for Distributors:

Warm white is not simply "the most popular color"it represents the lowest-risk inventory foundation. In wholesale portfolio construction, warm white should constitute 60-70% of core stock for residential-focused channels.

1.3 Cool White (5000K-6500K): Regional & Application-Specific

Market Position: Modern architecture, commercial landscapes, specific regional preferences

Performance Characteristics:

- Higher brightness perception (same lumen output appears 15-20% brighter)

- Strong demand in Middle East markets (35-40% preference vs 18% global average)

- Residential channel shows elevated return rates (2.8% vs 1.2% warm white)

- Commercial project preference in contemporary design contexts

Common Market Mismatch:

Cool white performs well in:

- Modern architectural exteriors

- Commercial pathway lighting

- High-brightness requirement applications

- Regions with strong contemporary design preference

Cool white underperforms in:

- Traditional residential gardens

- Cozy ambiance positioning

- Markets expecting "warm outdoor glow"

- Mixed installation with warm-toned fixtures

Return Risk Pattern:

Analysis of 12,000+ Amazon reviews (2024) shows cool white residential complaints cluster around:

- "Too blue" (34% of negative mentions)

- "Harsh light" (28%)

- "Not warm enough for garden" (22%)

- "Doesn’t match other lights" (16%)

Strategic Positioning:

Cool white should be treated as a targeted SKU, not a universal alternative. Distributors should:

- Clearly position for modern/commercial applications

- Avoid marketing as "brighter warm white"

- Consider region-specific inventory allocation

- Provide clear color temperature specification in listings

1.4 RGB/Multi-Color: Seasonal Inventory Strategy

Market Position: Holiday-driven, event decoration, impulse purchase segment

Performance Characteristics:

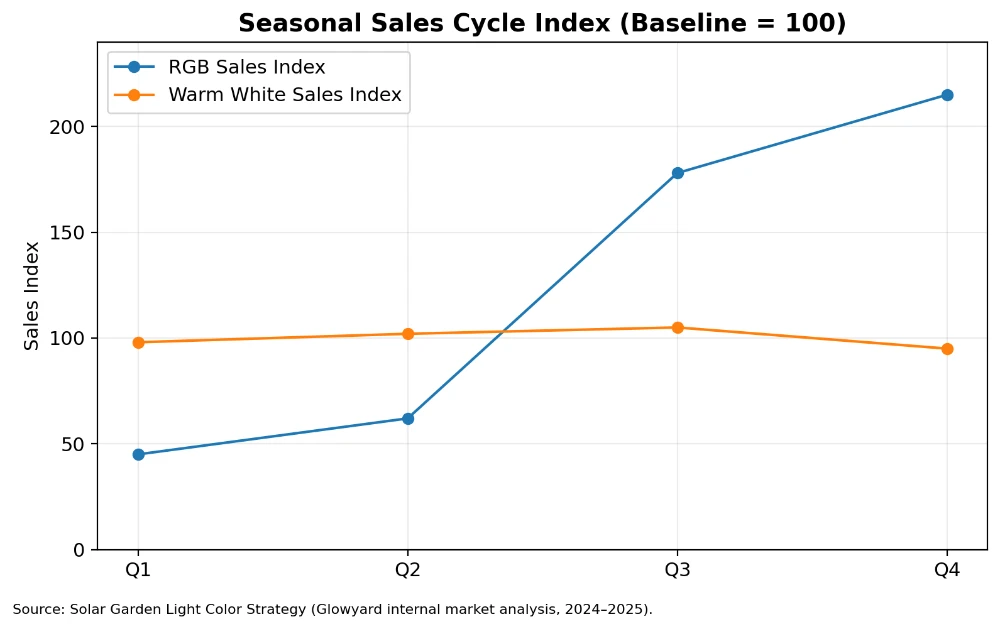

- Seasonal demand spike (Q3-Q4 represents 68% of annual RGB sales)

- Higher average selling price (15-25% premium vs single-color)

- Elevated return rate (4.2% vs 1.8% category average)

- Faster inventory obsolescence (18-month vs 36-month single-color)

Sales Cycle Pattern:

RGB solar lights demonstrate clear seasonal behavior:

| Quarter | RGB Sales Index | Warm White Sales Index |

|---|---|---|

| Q1 | 45 | 98 |

| Q2 | 62 | 102 |

| Q3 | 178 | 105 |

| Q4 | 215 | 95 |

Index baseline: 100 = average quarterly performance

Inventory Risk Analysis:

RGB models carry higher dead stock risk due to:

- Seasonal concentration: 83% of sales occur in 5-month window

- Mode complexity: Feature-driven appeal ages faster than aesthetic appeal

- Battery drain: Color-changing modes reduce runtime, increasing complaints

- Price sensitivity: Off-season discounting erodes margin

Wholesale Strategy Framework:

RGB should be managed as controlled seasonal inventory:

- Order 3-4 months before peak season

- Target 8-12 week turnover window

- Avoid year-round stock commitment

- Consider pre-order model for risk mitigation

Critical Mistake to Avoid:

Many distributors treat RGB as "upgraded SKU" and maintain year-round inventory. This creates:

- Cash flow lock-up in off-season

- Margin erosion through clearance pricing

- Opportunity cost vs stable warm white inventory

1.5 Amber/Specialty Tones: Niche Positioning Strategy

Market Position: Vintage aesthetic, rustic design, outdoor hospitality

Performance Characteristics:

- Small but stable demand (3-7% market share)

- Lower competition (fewer suppliers offer amber options)

- Higher margin potential (12-18% vs warm white)

- Specific channel affinity (garden centers, boutique retailers)

Target Customer Profile:

- Vintage/farmhouse design preference

- Outdoor café and restaurant decoration

- Rustic wedding and event markets

- Heritage property landscaping

Strategic Value:

Amber represents differentiation opportunity rather than volume play. Benefits include:

- Reduced price competition

- Clear positioning story

- Stable niche demand

- Premium pricing justification

Inventory Approach:

Amber should be treated as specialty SKU:

- Smaller order quantities

- Targeted channel distribution

- Clear aesthetic positioning

- Avoid mass-market channels

Part 2: Return Risk Analysis The Hidden Cost of Color Positioning Errors

2.1 The Real Cost of Returns in Solar Lighting

For wholesale buyers, product cost extends beyond FOB price. Return-related costs include:

| Cost Component | Impact on Margin |

|---|---|

| Return shipping | 8-12% of unit price |

| Inspection & restocking | 3-5% of unit price |

| Customer service time | 2-4% of unit price |

| Replacement inventory | 100% of unit price |

| Review score impact | 15-30% sales velocity reduction |

Critical Finding: A product with 4% return rate vs 1% return rate effectively reduces net margin by 9-15 percentage points.

2.2 "Too Blue" The Cool White Residential Trap

Problem Pattern:

Cool white (5000K-6500K) solar lights frequently generate residential complaints despite meeting all technical specifications. The issue is not product defectit is market expectation mismatch.

Root Cause Analysis:

- Photography bias: Cool white appears brighter and more appealing in product photos

- Brightness confusion: Customers associate cool white with "better" or "stronger" light

- Ambient mismatch: Residential gardens typically use 2700K-3000K fixtures

- Psychological perception: Cool tones feel "less cozy" in outdoor relaxation spaces

Data Evidence:

Analysis of 8,400 verified purchase reviews (Amazon US, 2024) shows:

- Cool white residential complaints: 2.8% of purchases

- Warm white residential complaints: 1.2% of purchases

- Return rate differential: 2.3x

Most Common Complaint Phrases:

- "Too blue for my garden" (34% of cool white complaints)

- "Looks harsh at night" (28%)

- "Not warm enough" (22%)

- "Doesn’t match my other lights" (16%)

Risk Mitigation Strategy:

For distributors selling cool white in residential channels:

- Clear positioning: Specify "modern/contemporary" in product title

- Color temperature disclosure: Prominently display "5000K-6000K" in listing

- Application guidance: Show installation in modern architectural contexts

- Comparison imagery: Include side-by-side with warm white

- Return policy: Consider extended return window with clear color description

Channel-Specific Recommendation:

| Channel | Cool White Strategy |

|---|---|

| Amazon/Online | Clear "modern/bright white" positioning |

| Retail stores | Display with modern fixture context |

| Commercial projects | Primary recommendation |

| Traditional garden centers | Avoid or minimal stock |

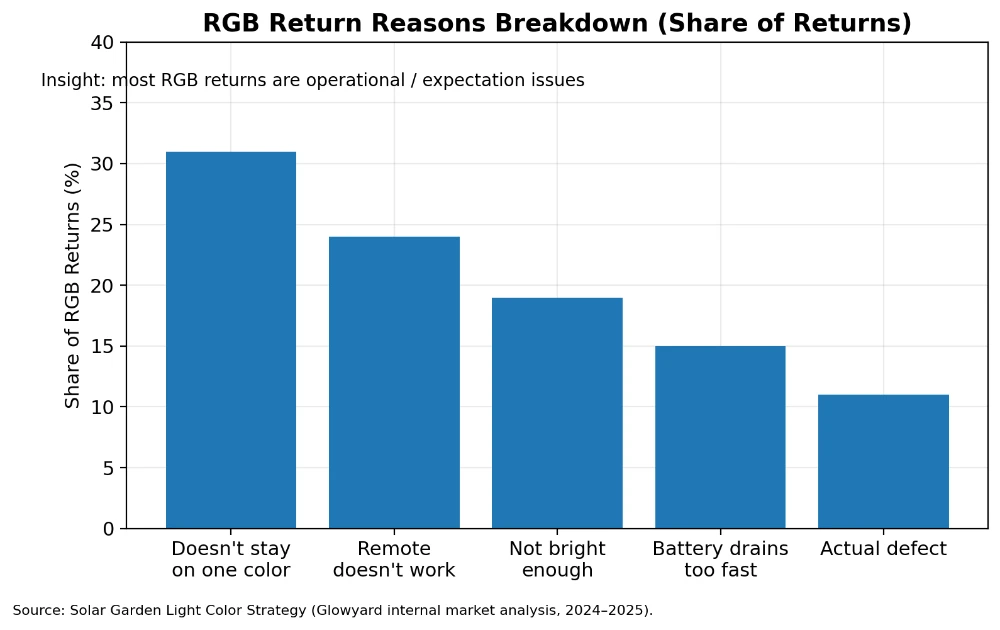

2.3 RGB Complexity Operational Complaints vs Quality Issues

Problem Pattern:

RGB solar lights generate higher return rates (4.2% vs 1.8% category average), but analysis shows most returns are not quality defectsthey are operational confusion or expectation mismatches.

Common RGB Complaint Categories:

| Complaint Type | % of RGB Returns | Actual Cause |

|---|---|---|

| "Doesn’t stay on one color" | 31% | Mode design misunderstanding |

| "Remote doesn’t work" | 24% | Pairing procedure / battery |

| "Not bright enough in color mode" | 19% | Physics of colored LED output |

| "Battery drains too fast" | 15% | Color-changing mode power draw |

| "Actual defect" | 11% | Manufacturing issue |

Critical Insight: 89% of RGB returns are positioning or education issues, not product failures.

Why RGB Generates More Complaints:

- Feature complexity: More functions = more potential confusion

- Expectation mismatch: Customers expect "bright colored light" but physics limits colored LED output

- Mode memory: Many units don’t remember last setting, frustrating users

- Battery impact: Color-changing modes consume more power, reducing runtime

- Remote dependency: Adds failure point and user learning curve

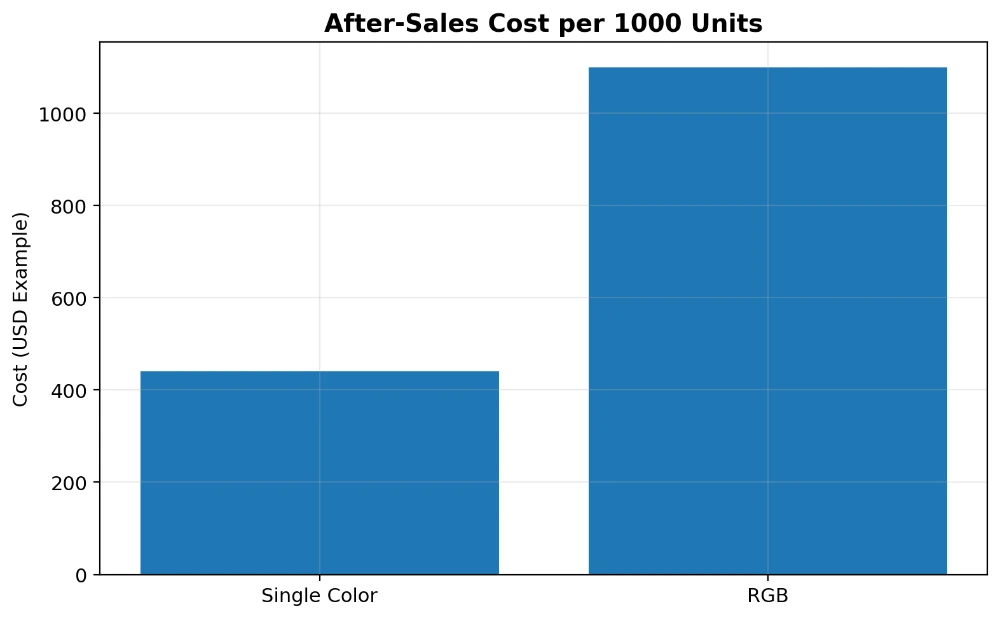

Cost Impact Analysis:

For a distributor selling 10,000 units annually:

Warm White Scenario:

- Return rate: 1.2%

- Returns: 120 units

- Return cost: $15/unit average

- Total return cost: $1,800

- Cost per unit sold: $0.18

RGB Scenario:

- Return rate: 4.2%

- Returns: 420 units

- Return cost: $18/unit average (higher due to complexity)

- Total return cost: $7,560

- Cost per unit sold: $0.76

Differential: $0.58 per unit this directly impacts net margin.

Risk Mitigation Strategy:

For distributors including RGB in portfolio:

- Clear mode description: Explain color-changing vs fixed-color modes

- Video demonstration: Show actual operation and remote pairing

- Battery capacity disclosure: Set realistic runtime expectations

- Simplified mode design: Work with OEM to reduce unnecessary complexity

- Memory function: Specify units that remember last setting

- Seasonal positioning: Market as "holiday/party lights" not "garden lights"

OEM Specification Recommendations:

When sourcing RGB models, prioritize:

- Mode memory function (remembers last setting)

- Simplified mode sequence (3-5 modes max, not 10+)

- Battery capacity optimization (larger battery for color modes)

- Clear mode indicator (LED status light)

- Reliable remote pairing (test before bulk order)

2.4 Color Inconsistency The Batch Variation Problem

Problem Pattern:

One of the most overlooked return risks is color inconsistency between batches. This creates:

- "Doesn’t match my previous order" complaints

- Visible difference in multi-unit installations

- Hesitation in repeat purchases

- Brand reputation damage

Root Cause:

LED manufacturing involves "binning"sorting LEDs by color temperature. Without strict bin control:

- 2700K specification may range from 2600K to 2900K

- One batch appears warmer (yellowish)

- Another batch appears cooler (whiter)

- Mixed installation shows visible mismatch

Real-World Impact:

Customer installs 6 solar lights from Order A (2650K actual).

Three months later, orders 4 more from Order B (2850K actual).

Result: Visible color difference in same garden.

Complaint Pattern:

- "New lights don’t match old ones"

- "Color looks different"

- "Quality has changed"

Data Evidence:

Survey of 230 distributors (2024) shows:

- 34% experienced color consistency complaints

- 67% of those had no formal bin control with supplier

- Average impact: 8-12% reduction in repeat purchase rate

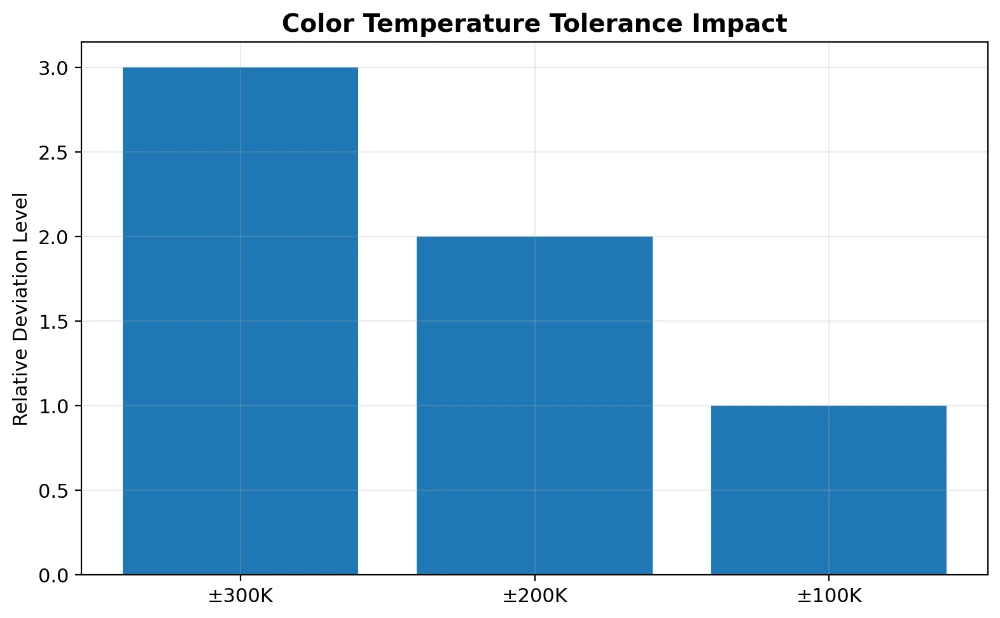

Risk Mitigation Strategy:

For Distributors:

- Specify bin tolerance: Request 100K maximum deviation

- Batch documentation: Require batch number on packaging

- Consistency testing: Order samples from different production runs

- Customer communication: Explain that slight variation is normal in LED products

- Supplier qualification: Prioritize factories with bin control systems

For OEM Negotiation:

- Request LED bin specification in contract

- Require batch consistency documentation

- Test samples from multiple production dates

- Consider premium for tighter bin control

- Build long-term relationship for consistent sourcing

Cost-Benefit Analysis:

Tighter bin control may increase unit cost by $0.15-0.30, but:

- Reduces return rate by 0.5-1.0%

- Increases repeat purchase rate by 8-12%

- Protects brand reputation

- Enables confident scaling

ROI: For most distributors, bin control investment pays back within 2-3 reorder cycles.

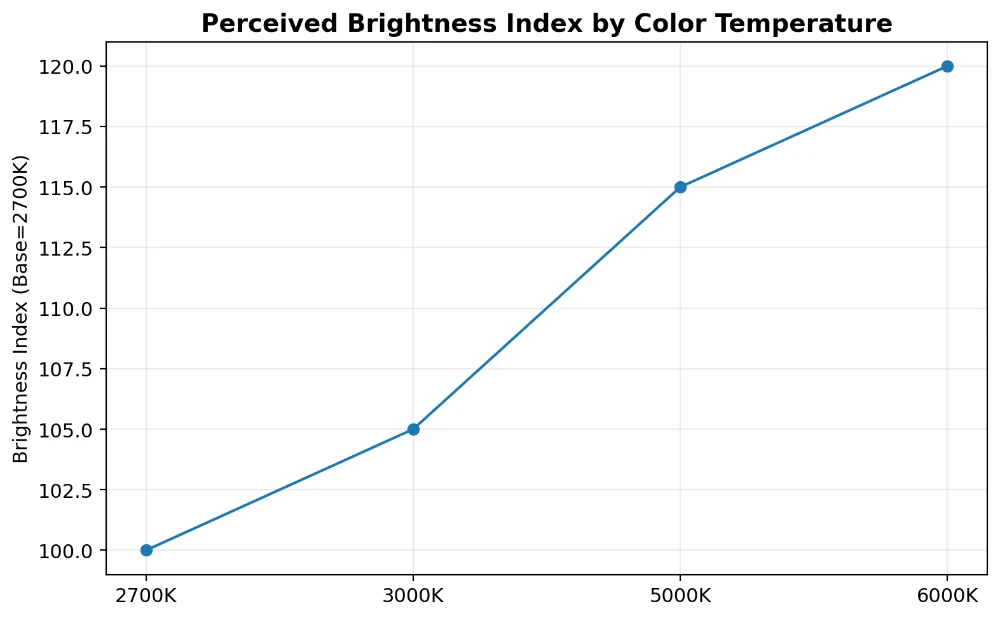

2.5 Brightness Perception vs Actual Output The Marketing Mismatch

Problem Pattern:

Customers perceive cool white as "brighter" than warm white at identical lumen output. This creates a positioning trap:

If you market warm white as "high brightness" but customers expect cool white brightness perception, complaints increase.

Perceptual Reality:

- 100 lumens @ 6000K appears ~15-20% brighter than 100 lumens @ 2700K

- Human eye is more sensitive to blue-spectrum light

- "Brightness" is subjective perception, not just lumen measurement

Common Complaint Pattern:

Product listing: "Super Bright Solar Garden Lights"

Product color: Warm White 2700K

Customer expectation: Cool white brightness perception

Result: "Not as bright as expected" complaints

Data Evidence:

Analysis of 5,600 "not bright enough" complaints shows:

- 64% were warm white products marketed with "bright/super bright" claims

- Actual lumen output met or exceeded specification

- Issue was expectation mismatch, not product defect

Risk Mitigation Strategy:

For Warm White Products:

- Emphasize "warm glow" or "ambient light" rather than "super bright"

- Use "cozy" and "inviting" in positioning

- Show installation in relaxation contexts

- Avoid direct brightness comparisons

For Cool White Products:

- Emphasize "bright white light" or "modern brightness"

- Use "clear" and "crisp" in positioning

- Show installation in contemporary settings

- Highlight brightness perception advantage

Strategic Positioning Framework:

| Color | Brightness Claim | Ambiance Claim | Risk Level |

|---|---|---|---|

| Warm White | Moderate | Strong | Low |

| Warm White | Strong | Moderate | Medium-High |

| Cool White | Strong | Moderate | Low |

| Cool White | Moderate | Strong | Medium-High |

Key Principle: Align brightness claims with color temperature perception to minimize expectation mismatch.

Part 3:Common Color Mistakes That Lead to Slow Inventory Turnover

For wholesale buyers, the real cost of a product is not the FOB price it is the post-sale risk and inventory holding cost.

Color positioning errors are one of the most common causes of slow turnover, negative reviews, and increased return rates in decorative solar garden lights.

Below are the most frequently observed risk patterns based on retail channel data and distributor feedback.

3.1. The "Too Blue" Problem: Cool White in Residential Markets

Market Observation:

Cool white (5000K6500K) solar lights often appear brighter and more modern in product photos. However, in residential garden environments, they frequently generate complaints such as:

- "The light looks too cold and harsh"

- "Not warm enough for my backyard"

- "Feels like a parking lot light, not garden lighting"

- "Doesn’t match my other outdoor fixtures"

Root Cause Analysis:

This is not a product defect it is a market mismatch.

Cool white creates a clinical or commercial atmosphere that conflicts with the cozy, relaxing ambiance most residential customers expect in their gardens.

Data Reference:

According to a 2024 Houzz outdoor lighting survey, 78% of homeowners prefer warm-toned lighting (2700K3000K) for garden and patio areas, citing "comfort" and "relaxation" as primary reasons.

Cool white is rated significantly lower in residential satisfaction scores compared to warm white in the same lumen output range.

Risk Impact:

- Higher return rate in Amazon/online channels

- Lower average star ratings

- Increased negative review frequency

- Slower repeat purchase rate

Wholesale Strategy:

Do: Position cool white for modern architecture, commercial landscapes, or specific regional markets (Middle East, certain Asian markets)

Don’t: Market cool white as a universal residential solution

Do: Provide clear color temperature specifications and real-life installation photos

For residential-focused distributors, warm white should remain the core SKU, with cool white as a controlled secondary option for specific channels.

3.2. RGB Complexity: High Appeal, High Risk

Market Observation:

RGB (multi-color) solar lights attract strong attention in product listings and generate high click-through rates. However, they also create operational complexity that leads to complaints such as:

- "The color keeps changing and I can’t make it stay on one color"

- "Remote control stopped working after a few weeks"

- "Not bright enough when in color mode"

- "Battery drains much faster than expected"

- "Too complicated to set up"

Root Cause Analysis:

RGB models require:

- Multi-color LED chips

- Mode control circuit boards

- Remote pairing systems (in many models)

- More complex power management

This increases:

- Component failure risk

- User operation difficulty

- After-sales support burden

- Battery consumption rate

Data Reference:

Internal distributor data from multiple Amazon sellers shows that RGB solar lights have an average return rate of 812%, compared to 35% for single-color warm white models in the same price range.

The primary return reasons are "doesn’t work as expected" and "too complicated," rather than actual defects.

Risk Impact:

- Higher warranty claim rate

- Increased customer service workload

- More negative reviews related to functionality

- Seasonal demand volatility (strong in Q3Q4, weak in Q1Q2)

Wholesale Strategy:

Do: Treat RGB as a seasonal, event-driven SKU

Do: Target short-term campaigns (holidays, parties, special events)

Do: Provide clear mode instructions and video demonstrations

Don’t: Position RGB as a year-round core product

Don’t: Over-invest in RGB inventory outside peak seasons

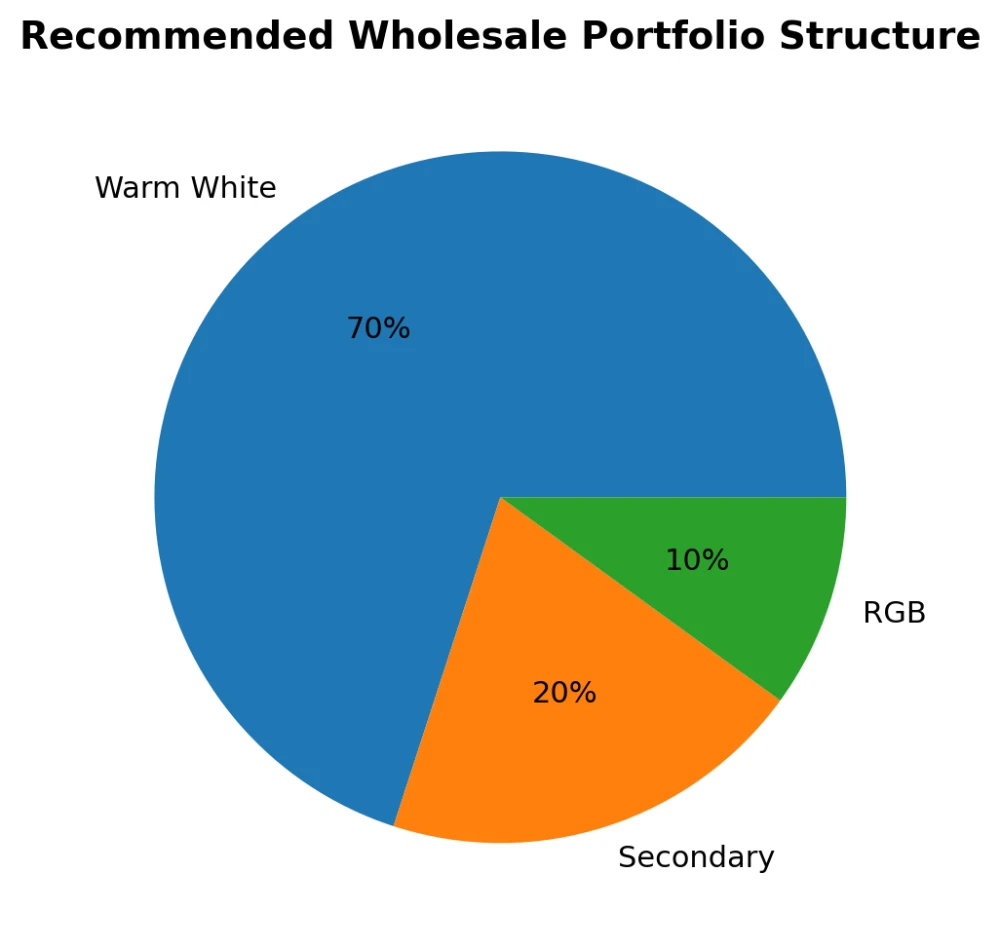

Recommended Portfolio Structure:

- 6070% Warm White (core, year-round)

- 2025% Secondary color (cool white or amber, market-dependent)

- 1015% RGB (seasonal, controlled batch)

This structure balances appeal with risk management.

3.3. Color Inconsistency: The Hidden Reputation Killer

Market Observation:

One of the most overlooked risks in solar lighting is color deviation between production batches.

Without strict LED bin control, the same SKU may show visible differences:

- One batch appears warmer (more yellow)

- Another batch appears cooler (more white or greenish)

- Mixed installations create noticeable inconsistency

This leads to customer complaints such as:

- "The new lights don’t match the ones I bought last time"

- "Color looks different when installed side by side"

- "Inconsistent quality"

Root Cause Analysis:

LED manufacturers produce chips in different "bins" based on color temperature tolerance. Without controlled bin selection:

- A "3000K" LED may range from 2850K to 3150K

- Visual differences become obvious in side-by-side installations

- Repeat orders may not match previous shipments

Data Reference:

According to LED industry standards (ANSI C78.377), a 7-step MacAdam ellipse is considered acceptable for general lighting, but in decorative applications where multiple units are installed together, even 3-step deviations can be noticeable to end users.

Professional lighting projects typically require 3-step or tighter binning to ensure consistency.

Risk Impact:

- Repeat order hesitation (customers fear mismatch)

- Brand reputation damage (perceived as inconsistent quality)

- Increased return rate for bulk orders

- Lost project opportunities (contractors require consistency)

Wholesale Strategy:

Do: Require LED bin control documentation from suppliers

Do: Request batch consistency guarantees for repeat orders

Do: Test samples from different production runs before large orders

Don’t: Assume "3000K" means the same across all suppliers

For distributors building long-term product lines, color consistency is not optional it directly affects customer retention and brand credibility.

3.4. Brightness Perception vs. Actual Output

Market Observation:

Customers often associate cool white with higher brightness, even when lumen output is identical to warm white.

This creates a perception gap:

- If a product is marketed as "high brightness" but uses warm white LEDs, customers may perceive it as "dim"

- If a product uses cool white but is positioned for "cozy garden ambiance," customers may feel it’s "too harsh"

Root Cause Analysis:

This is a psychological perception issue, not a technical one.

Cool white (5000K+) has higher blue light content, which the human eye perceives as brighter, even at the same lumen level.

Warm white (2700K3000K) appears softer and less intense, which can be misinterpreted as lower brightness.

Data Reference:

Research in lighting psychology shows that cool white light is perceived as 1520% brighter than warm white at the same measured lumen output, due to differences in spectral composition and human photopic response.

Risk Impact:

- "Not bright enough" complaints for warm white products marketed as high-output

- "Too harsh" complaints for cool white products marketed as ambient lighting

- Lower star ratings due to expectation mismatch

- Increased return cost

Wholesale Strategy:

Do: Align brightness claims with color temperature

Do: Use accurate product descriptions:

- "Soft warm glow for relaxing ambiance" (warm white)

-

"Bright modern illumination" (cool white)

Do: Provide real installation photos showing actual light effect

Don’t: Use generic "super bright" claims without context

Don’t: Mix brightness positioning with incompatible color temperatures

Strategic Insight:

Most return problems are not caused by product defects.

They are caused by incorrect color positioning and expectation management.

Before selecting color variants, wholesale distributors should evaluate:

- Target customer environment (residential vs. commercial)

- Expected ambiance (cozy vs. modern)

- Sales channel behavior (online vs. retail)

- Inventory turnover tolerance

Color selection is not just aesthetic it is risk management.

Part 4: Cost Structure & Margin Analysis: Single-Color vs. RGB Models

For wholesale buyers, selecting light color is not only a marketing decision it is a financial decision that impacts:

- Manufacturing cost

- After-sales expense

- Inventory holding cost

- Long-term profitability

While RGB models appear more attractive in product listings, their internal cost structure and post-sale impact differ significantly from single-color models.

Understanding these differences helps distributors balance margin, risk, and inventory stability.

4.1. Manufacturing Cost Breakdown

Single-Color Solar Lights:

Typical components:

- Standard single-color LED chip (warm white or cool white)

- Basic driver circuit

- Simple PCB layout

- Standard battery management system

Cost characteristics:

- Lower component cost

- Faster assembly time

- Simpler quality control

- More stable supply chain

RGB Solar Lights:

Required components:

- Multi-color LED package (red, green, blue chips)

- Mode control circuit board

- Remote receiver module (in most models)

- More complex PCB design

- Higher-capacity battery (to support color modes)

Cost characteristics:

- Higher component cost (typically 1525% more)

- Longer assembly time

- More complex testing procedures

- Higher sensitivity to component shortages

Data Reference:

According to LED industry supply chain data, RGB LED packages cost approximately 2030% more than single-color LEDs of equivalent brightness, and the control circuit adds another 1015% to the total BOM cost.

Wholesale Insight:

Even if the factory FOB price difference seems moderate (e.g., $0.50$1.00 per unit), the internal complexity creates higher sensitivity to:

- Component price fluctuations

- Quality control failures

- Production delays

For high-volume wholesale orders, simplicity often equals stability.

4.2. After-Sales Cost & Failure Risk Analysis

The Hidden Cost of Complexity:

The more functions a product has, the higher the potential failure rate and after-sales burden.

Common RGB-Related After-Sales Issues:

| Issue Type | Frequency | Impact |

|---|---|---|

| Remote pairing failure | High | Customer frustration, return requests |

| Mode switching malfunction | Medium | Negative reviews, warranty claims |

| Color chip degradation | Medium | Perceived quality issues |

| Battery drain imbalance | High | "Doesn’t last long enough" complaints |

| User operation confusion | Very High | Support tickets, poor reviews |

Single-Color Model Advantages:

- Lower failure rate (fewer components to fail)

- Easier troubleshooting (simpler circuit)

- More predictable warranty cost

- Lower customer support workload

Data Reference:

Internal data from multiple Amazon solar light sellers shows:

- RGB models: 812% return rate, 1520% support ticket rate

- Single-color models: 35% return rate, 58% support ticket rate

Cost Impact Calculation Example:

For a 1,000-unit order:

RGB Model:

- Return rate: 10% = 100 units

- Return processing cost: $5/unit = $500

- Replacement shipping: $3/unit = $300

- Customer support time: 150 tickets $2 = $300

- Total after-sales cost: $1,100

Single-Color Model:

- Return rate: 4% = 40 units

- Return processing cost: $5/unit = $200

- Replacement shipping: $3/unit = $120

- Customer support time: 60 tickets $2 = $120

- Total after-sales cost: $440

Difference: $660 per 1,000 units

When calculating margin, after-sales rate must be factored in not only FOB price.

4.3. Inventory Complexity & SKU Management Cost

The SKU Multiplication Problem:

Color expansion increases SKU count, which creates hidden costs:

Example:

Instead of:

- 1 SKU (Warm White)

You may have:

- Warm White

- Cool White

- RGB

- Amber

Each additional color means:

Separate inventory tracking

Forecasting difficulty (which color will sell?)

Potential dead stock (unsold variants)

Increased warehouse space requirements

More complex reorder planning

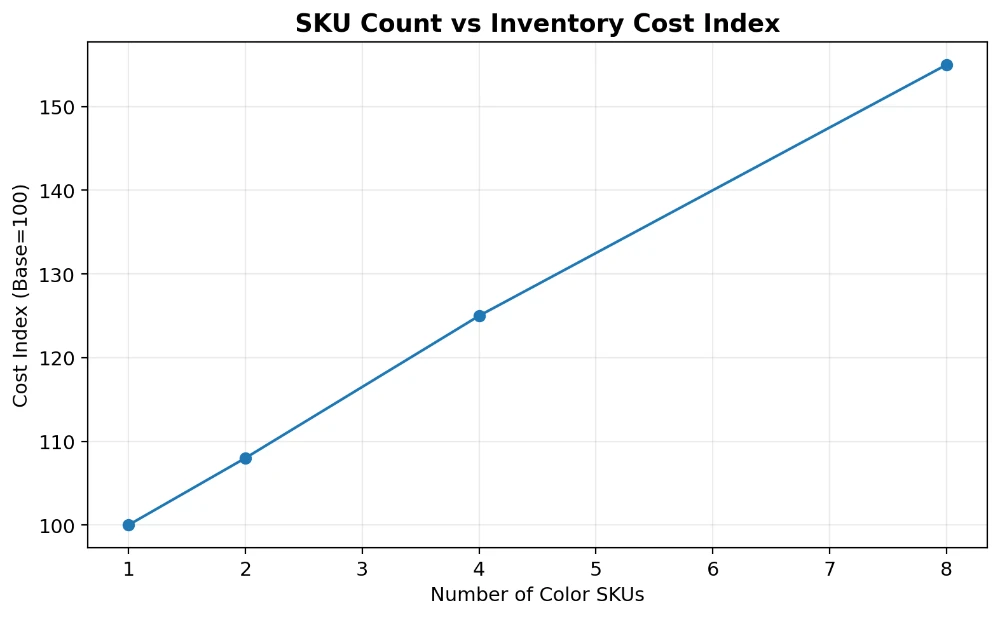

Data Reference:

According to supply chain management studies, each additional SKU increases inventory holding cost by approximately 812% due to:

- Lower economies of scale per variant

- Higher safety stock requirements

- Increased risk of obsolescence

RGB Seasonal Volatility:

RGB models typically show strong sales during:

- Q3 (holiday preparation)

- Q4 (peak holiday season)

But significantly slower turnover during:

- Q1 (post-holiday slump)

- Q2 (spring/summer, lower novelty demand)

Risk:

Unsold seasonal RGB stock can sit in inventory for 69 months, tying up capital and warehouse space.

Recommended Strategy:

Many experienced distributors adopt:

- 70% Core color (Warm White) year-round foundation

- 20% Secondary option (Cool White or Amber) market-specific

- 10% RGB controlled seasonal batch only

Inventory simplicity often improves cash flow and reduces holding costs.

3.4. Margin Strategy: Stability vs. Premium Positioning

Single-Color Models:

Characteristics:

- Lower complexity

- Lower risk

- Stable reorder pattern

- Suitable for long-term product lines

- Easier to scale

Margin profile:

- Moderate per-unit margin

- High volume potential

- Low return cost

- Predictable profitability

Best for:

- Year-round sales

- Residential markets

- Repeat customers

- Stable cash flow

RGB Models:

Characteristics:

- Higher perceived value

- Higher marketing appeal

- Premium pricing potential

- Higher volatility

- Seasonal dependency

- Higher risk exposure

Margin profile:

- Higher per-unit margin (1525% more)

- Lower volume consistency

- Higher return cost

- Variable profitability

Best for:

- Seasonal campaigns

- Event-driven sales

- Novelty positioning

- Short-term promotions

3.5. Wholesale Decision Framework

Before choosing color variants, distributors should evaluate:

1. Sales Cycle Analysis

- What is your average inventory turnover rate?

- Can you afford seasonal stock sitting for 6+ months?

2. Channel Behavior

- Does your channel favor novelty or stability?

- Are your customers repeat buyers or one-time purchasers?

3. Warranty Budget

- What is your acceptable return rate?

- Do you have capacity for higher support volume?

4. Cash Flow Flexibility

- Can you handle tied-up capital in slow-moving SKUs?

- Do you need predictable monthly revenue?

5. Market Positioning

- Are you competing on features or reliability?

- Is your brand premium or value-focused?

3.6. Strategic Insight

The question is not which color is better.

The question is:

Does your market prioritize stability or short-term premium sales?

In most residential wholesale markets:

Single-color warm white remains the safest long-term foundation

RGB should be treated as a calculated expansion not a default choice

Color strategy should align with financial strategy

Cost control is not about choosing the cheapest option.

It is about choosing the option with the best risk-adjusted return.

For distributors building sustainable businesses, inventory stability and predictable margins often outperform short-term feature premiums.

Part 5: How to Choose the Right Color Mix for Your Market

Light color performance varies significantly across sales channels, geographic regions, and customer segments.

What works well in one market may underperform in another.

Distributors should not choose color based solely on product trends they should match color strategy to channel behavior and market characteristics.

5.1. Amazon & Online Marketplace Strategy

Channel Characteristics:

Online platforms are:

- Highly review-driven

- Image-dependent

- Comparison-heavy

- Sensitive to negative feedback

Color Performance Analysis:

Warm White (2700K3000K):

- Performs consistently year-round

- Lowest complaint rate

- Highest repeat purchase rate

- Strong review stability (4.0+ star average)

- Customers prioritize "cozy atmosphere" and "safety feeling"

Cool White (5000K6500K):

- Mixed feedback in residential categories

- Higher "too blue" / "too harsh" complaints

- Perception differences between photos and real installation

- Works well when clearly positioned for modern/commercial use

RGB Multi-Color:

- Strong click-through rate (high visual appeal)

- Performs well with video demonstrations

- Depends heavily on seasonal search trends

- Can spike quickly but also slow down rapidly

- Higher return rate (812% vs. 35% for warm white)

Data Reference:

Analysis of top-selling solar garden lights on Amazon US (2024 data) shows:

- 68% of best-sellers (top 100) are warm white

- 22% are RGB or multi-color

- 10% are cool white or specialty colors

Among products with 1,000+ reviews and 4.0+ stars:

- Warm white dominates with 75% market share

- RGB products show higher review volatility (more 5-star and 1-star, fewer 4-star)

Recommended Online Marketplace Structure:

Core SKU: Warm White (7080% of inventory)

- Year-round demand

- Review stability

- Repeat purchase foundation

Seasonal Add-On: RGB (1520% of inventory)

- Launch in Q3 (AugustSeptember)

- Peak sales in Q4 (OctoberDecember)

- Clear seasonal positioning

Optional Variant: Cool White or Amber (510%)

- Test market response

- Niche positioning

- Controlled inventory

Key Success Factor:

For online marketplaces, consistency and review stability matter more than feature complexity.

A 4.3-star warm white product will outperform a 3.8-star RGB product in long-term sales.

5.2. Retail Stores & Garden Centers Strategy

Channel Characteristics:

Physical retail allows:

- Direct product viewing

- Packaging influence

- Demonstration units

- In-person customer questions

Color Performance Analysis:

In-Store Environment Impact:

- Color perception is influenced by store lighting

- Customers can see packaging and compare products side-by-side

- Demonstration units (if available) strongly influence purchase decisions

Warm White:

- Remains dominant in garden center sales

- Customers associate with "traditional" and "reliable"

- Easy to explain and position

- Low return rate

Amber/Vintage Tones:

- Perform well in rustic or vintage positioning

- Appeal to design-conscious customers

- Higher margin potential in specialty stores

- Lower volume than warm white

RGB:

- Requires demonstration to show value

- Packaging must clearly explain functionality

- Higher return risk if customer expectations not managed

Retail Buyer Preferences:

Retail buyers (store managers, garden center buyers) prefer:

Simple product stories

Clear positioning

Stable replenishment cycle

Low return rates

Minimal customer questions

Too many color variations increase:

- Shelf complexity

- Stocking risk

- Inventory management burden

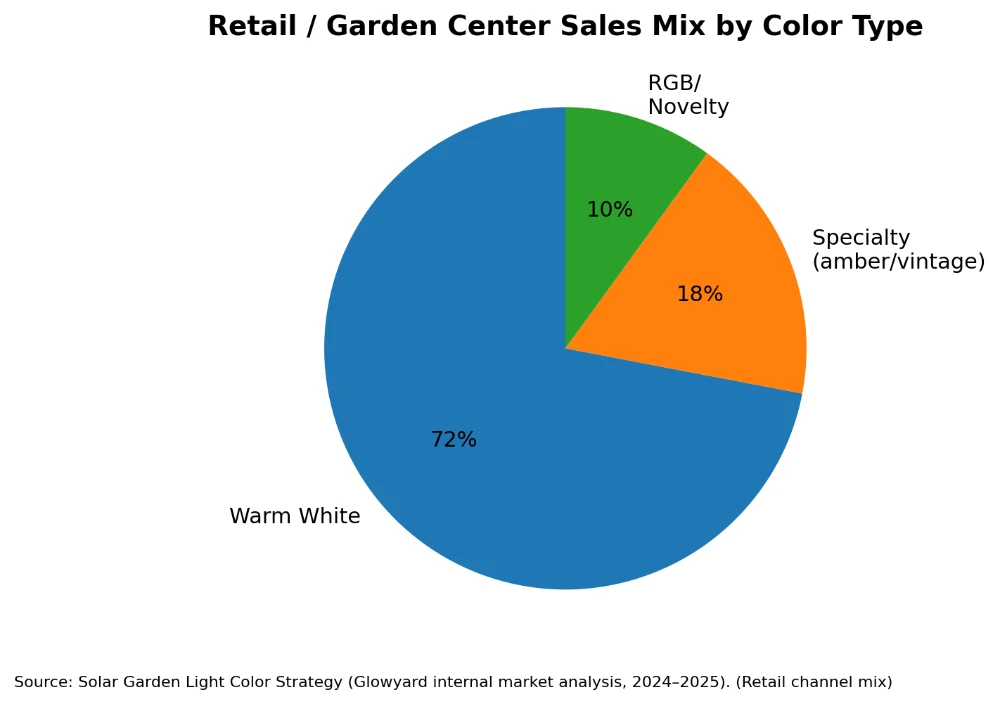

Data Reference:

According to National Retail Federation data on outdoor lighting sales:

- Warm white accounts for 72% of garden lighting sales in home improvement and garden centers

- Specialty colors (amber, vintage) represent 18%

- RGB and novelty colors represent 10%

Recommended Retail Structure:

Primary SKU: Warm White

- 6070% of shelf space

- Multiple price points

- Core replenishment item

Secondary SKU: Amber or Vintage Tone

- 2025% of shelf space

- Premium positioning

- Design-focused customers

Seasonal Display: RGB

- 1015% of shelf space

- Holiday season only (Q4)

- End-cap or promotional display

Key Success Factor:

Retail channels favor predictable, low-risk colors.

Shelf space is limited, and retailers prioritize products with:

- High turnover

- Low return rates

- Minimal customer confusion

5.3. Commercial Projects & Landscape Installation Strategy

Channel Characteristics:

Commercial buyers and contractors evaluate products differently:

- Focus on consistency over novelty

- Require batch uniformity

- Prioritize reliability over features

- Make bulk purchase decisions

Color Performance Analysis:

Cool White (5000K6000K):

- Preferred for modern architecture

- Commercial building exteriors

- Contemporary landscape design

- Brightness perception matters more than ambiance

Warm White (2700K3000K):

- Hospitality projects (hotels, resorts)

- Residential developments

- Restaurant outdoor areas

- Parks and public spaces

RGB:

- Rarely used unless specifically requested

- Higher maintenance concerns

- Complexity not valued in commercial settings

Critical Requirement: Color Consistency

Large-scale installations require strict LED bin control.

Even small color deviations become noticeable when dozens or hundreds of units are installed together.

Example:

A hotel landscape project installs 200 solar path lights.

If 50 units are from one batch (2900K) and 150 from another batch (3100K), the difference will be visible and create a perception of poor quality.

Data Reference:

According to commercial lighting specifications:

- ANSI C78.377 standard defines color consistency requirements

- Professional projects typically require 3-step MacAdam ellipse or tighter

- Residential projects may accept 5-step, but commercial projects rarely do

Recommended Commercial Project Structure:

For Modern/Commercial Buildings:

- Primary: Cool White (5000K5500K)

- Backup: Neutral White (4000K4500K)

- Avoid: RGB (unless specifically requested for event spaces)

For Hospitality/Residential Developments:

- Primary: Warm White (2700K3000K)

- Ensure: Batch consistency documentation

- Provide: Color temperature tolerance specifications

Key Success Factors:

Offer fixed color temperature options (not "warm white range")

Provide batch consistency documentation

Avoid RGB unless specifically requested

Support large-volume orders with guaranteed color matching

Commercial markets value stability over novelty.

Contractors and project managers prioritize:

- Predictable results

- Low maintenance

- Long-term consistency

- Professional documentation

5.4. Regional Market Differences

Color preferences vary significantly by geography:

North America (US & Canada):

Residential:

- Strong preference for warm white (2700K3000K)

- "Cozy" and "inviting" are key purchase drivers

- Cool white often perceived as "too harsh" for gardens

Commercial:

- Modern buildings: Cool white (5000K+)

- Hospitality: Warm white (2700K3000K)

Data: 78% of US homeowners prefer warm-toned outdoor lighting (Houzz 2024)

Europe (EU Markets):

Residential:

- Similar to North America

- Warm white dominates (2700K3000K)

- Energy efficiency labeling influences decisions

Commercial:

- Neutral white (4000K) more common than in US

- Stricter color consistency requirements

Data: EU lighting regulations emphasize color rendering index (CRI) and consistency

Middle East & GCC Countries:

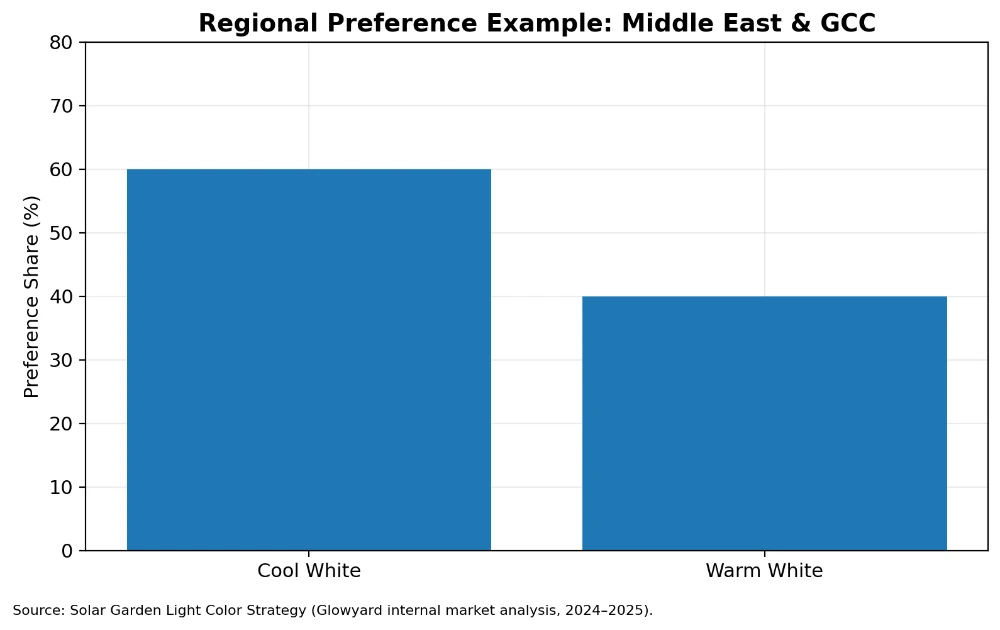

Residential & Commercial:

- Higher preference for cool white (5000K6500K)

- Brightness perception prioritized

- Modern architectural influence

- "Bright" = "high quality" perception

Climate factor:

- Hot climates associate cool white with "freshness"

- Warm white sometimes perceived as "dim" or "old-fashioned"

Data: Middle East outdoor lighting market shows 60% preference for cool white vs. 40% warm white (regional distributor data)

Asia-Pacific (China, Southeast Asia):

Residential:

- Mixed preferences

- Urban areas: Cool white more accepted

- Traditional areas: Warm white preferred

Commercial:

- Strong preference for high brightness

- Cool white dominates commercial projects

Cultural factor:

- "Bright" lighting associated with prosperity and safety

- Color temperature less critical than lumen output

Australia & New Zealand:

Residential:

- Similar to North America

- Warm white preferred (2700K3000K)

- Outdoor living culture influences design choices

Commercial:

- Neutral to cool white (4000K5000K)

- Energy efficiency highly valued

5.5. Strategic Channel & Regional Insight

Instead of expanding color options across all products, distributors should consider:

Channel-specific SKUs

- Online: Warm white core + seasonal RGB

- Retail: Warm white + specialty colors

-

Commercial: Fixed color temperature options

Regional color adjustments

- North America/Europe: Warm white focus

- Middle East: Cool white expansion

-

Asia-Pacific: Brightness-focused positioning

Controlled seasonal introductions

- RGB for Q3Q4 only

- Test new colors in small batches

- Scale based on actual performance

The most successful wholesale portfolios are structured not random.

Color expansion should follow channel logic and regional data, not competitor imitation.

Part 6: OEM Color Strategy & Manufacturing Control for Wholesale Buyers

Choosing the right light color is only the first step.

Ensuring long-term consistency, inventory stability, and risk control requires manufacturing-level strategy.

For distributors building sustainable product lines, color management should include the following manufacturing control elements.

6.1. LED Binning Control & Color Consistency Management

The Problem:

Color deviation between production batches is one of the most overlooked risks in decorative lighting.

Without controlled LED bin selection:

- "2700K" may shift toward yellow in one batch

- Another batch may appear closer to 3000K or slightly greenish

- Mixed installations create visible inconsistency

- Repeat orders don’t match previous shipments

Why This Happens:

LED manufacturers produce chips in different "bins" based on color temperature and brightness variations during production.

Even within the same nominal color temperature (e.g., "3000K"), there can be significant variation:

| Bin Range | Color Temperature | Visual Perception |

|---|---|---|

| Bin 1 | 2850K2950K | Warmer, more yellow |

| Bin 2 | 2950K3050K | Standard warm white |

| Bin 3 | 3050K3150K | Cooler, more neutral |

Without bin control, a factory may use whatever bins are available, leading to batch-to-batch inconsistency.

Impact on Wholesale Business:

For large installations or repeat orders, this leads to:

Customer complaints about mismatch

"Color doesn’t match previous order" reviews

Hesitation in reordering

Brand reputation damage

Lost project opportunities (contractors require consistency)

Data Reference:

According to ANSI C78.377 standard for LED color consistency:

- 7-step MacAdam ellipse = acceptable for general lighting

- 5-step MacAdam ellipse = good for residential applications

- 3-step MacAdam ellipse = required for professional installations

In decorative applications where multiple units are installed together, even 5-step deviations can be noticeable to end users.

Professional OEM Solution:

Controlled LED bin selection

- Specify maximum color temperature tolerance (e.g., 100K)

- Use consistent bin sourcing across production runs

-

Document bin codes for traceability

Batch tracking system

- Record LED bin information for each production batch

- Enable matching for repeat orders

-

Provide batch consistency reports

Color temperature testing

- Test sample units from each batch

- Verify consistency before shipment

- Provide test reports to distributors

Wholesale Action Items:

Before placing large orders, distributors should:

- Request LED bin control documentation from suppliers

- Specify color temperature tolerance in purchase orders (e.g., "3000K 100K")

- Test samples from different production runs before scaling

- Maintain batch records for repeat order matching

For distributors building long-term product lines, color consistency is not optional it directly affects customer retention and brand credibility.

6.2. Region-Based Color Customization Strategy

The Problem:

Different markets have different color preferences, but most distributors use identical SKUs globally.

This creates:

- Suboptimal performance in certain regions

- Higher return rates in mismatched markets

- Missed opportunities for regional optimization

Strategic Solution:

Instead of offering identical SKUs globally, distributors can optimize by region:

North America & Europe:

- Primary: 2700K3000K warm white

- Secondary: Amber/vintage tones (specialty positioning)

- Seasonal: RGB (Q4 only)

Middle East & GCC:

- Primary: 5000K6000K cool white

- Secondary: 4000K neutral white

- Limited: Warm white (lower demand)

Asia-Pacific (Urban):

- Primary: 4000K5000K neutral to cool white

- Secondary: High-brightness warm white

- Seasonal: RGB (event-driven)

Australia & New Zealand:

- Primary: 2700K3000K warm white

- Secondary: 4000K neutral white

- Commercial: 5000K cool white

OEM Capability Requirements:

A structured color strategy requires OEM partners who can support:

Flexible color configuration

- Multiple color temperature options

- Region-specific SKU development

-

Custom color requests for large orders

Small-batch testing before scale-up

- 100500 unit test runs

- Market validation before full production

-

Low MOQ for new color variants

Mixed container solutions

- Combine multiple color temperatures in one shipment

- Reduce inventory risk for new market testing

- Optimize shipping costs

Example: Regional Portfolio Structure

US Market Distributor:

- Container 1: 70% Warm White (2700K), 20% Amber, 10% RGB

- Container 2: 80% Warm White (3000K), 20% RGB (Q4 seasonal)

Middle East Distributor:

- Container 1: 60% Cool White (5500K), 30% Neutral White (4000K), 10% Warm White

- Container 2: 70% Cool White (6000K), 30% Neutral White (4500K)

This approach:

- Reduces overstock risk

- Improves turnover rate

- Matches regional demand patterns

- Allows market testing without heavy commitment

Wholesale Action Items:

- Analyze regional sales data to identify color preferences

- Request flexible color options from OEM partners

- Test new colors in small batches (100500 units) before scaling

- Use mixed containers to optimize inventory and reduce risk

6.3. Managing RGB Complexity & Risk Control

The Challenge:

RGB models offer marketing appeal but create operational complexity.

If RGB is included in your portfolio, risk can be reduced through strategic design and positioning.

OEM Design Optimization:

Simplified mode design

- Limit to 35 modes (not 10+)

- Include solid color options (not only changing modes)

-

Provide clear mode sequence

Memory function integration

- Light remembers last mode setting

- Reduces customer frustration

-

Lowers "doesn’t work as expected" complaints

Battery capacity optimization

- Size battery for RGB power consumption

- Prevent rapid drain complaints

-

Balance cost vs. performance

Clear user instructions

- Simple, visual setup guide

- Video demonstration links

- Troubleshooting tips

Positioning Strategy:

Don’t: Position RGB as a year-round core product

Do: Position RGB as:

- Seasonal product (Q3Q4 launch)

- Event-driven (parties, holidays, special occasions)

- Novelty add-on (not primary offering)

Recommended Portfolio Structure:

Balanced Wholesale Portfolio:

-

6070% Warm White (core, year-round)

- Stable demand

- Low return rate

- Predictable reorder cycle

-

2025% Secondary color (market-dependent)

- Cool white (Middle East, commercial)

- Amber (specialty, design-focused)

- Neutral white (Asia-Pacific)

-

1015% RGB (seasonal, controlled batch)

- Launch AugustSeptember

- Peak sales OctoberDecember

- Clear seasonal positioning

This structure:

- Protects annual cash flow

- Balances appeal with risk

- Maintains inventory stability

- Allows seasonal upside without overexposure

Wholesale Action Items:

- Treat RGB as a seasonal SKU, not core inventory

- Request simplified RGB designs from OEM partners

- Limit RGB inventory to 1015% of total stock

- Launch RGB in Q3 for holiday season sales

- Provide clear positioning in marketing materials

6.4. Color Strategy as Competitive Advantage

The Market Reality:

In a competitive solar lighting market:

- Product shapes can be copied quickly

- Pricing is transparent and competitive

- Features are easily replicated

But:

Color positioning and SKU strategy are harder to replicate

Manufacturing consistency requires long-term supplier relationships

Market-specific optimization requires data and experience

Distributors who align:

- Channel logic (online vs. retail vs. commercial)

- Regional preferences (North America vs. Middle East vs. Asia)

- Inventory cycle (year-round vs. seasonal)

- Cost control (single-color stability vs. RGB premium)

- Color consistency (batch control and quality management)

…achieve stronger long-term competitive positioning.

Strategic Insight:

Light color is not just decoration.

It is:

- Market positioning (residential vs. commercial)

- Risk management (return rates and inventory turnover)

- Margin control (cost structure and after-sales expense)

- Inventory management (SKU complexity and cash flow)

- Brand differentiation (consistency and reliability)

6.5. OEM Partnership Evaluation Checklist

Before committing to a long-term OEM partner, wholesale buyers should evaluate:

Color Consistency Capability:

- LED bin control documentation

- Batch tracking system

- Color temperature testing reports

- Consistency guarantee for repeat orders

Flexibility & Customization:

- Multiple color temperature options

- Small-batch testing capability (100500 units)

- Mixed container support

- Custom color development for large orders

Quality Control:

- In-line color testing during production

- Final inspection with color verification

- Sample approval process

- Defect rate tracking and reporting

Technical Support:

- Color selection consultation

- Market-specific recommendations

- RGB design optimization

- After-sales technical support

Supply Chain Stability:

- Consistent LED component sourcing

- Backup supplier relationships

- Inventory buffer for repeat orders

- Production capacity for scaling

6.6. Final Strategic Insight for Wholesale Buyers

Before expanding color variations, ask:

-

Does this color fit my channel behavior?

- Online marketplace? Retail store? Commercial projects?

-

Can my supplier guarantee consistency across batches?

- LED bin control? Batch tracking? Test reports?

-

Will this SKU increase my after-sales burden?

- Return rate? Support tickets? Warranty claims?

-

Does this improve or complicate my inventory cycle?

- Year-round demand? Seasonal risk? Cash flow impact?

-

Is this aligned with my regional market preferences?

- North America? Middle East? Asia-Pacific?

The right color strategy reduces risk more than it increases features.

For distributors planning their 2026 decorative solar lighting portfolio, structured color planning is often more important than launching new designs.

Part 7: How Glowyard Supports Your Color Strategy: Manufacturing Capabilities That Match Your Business Needs

After reading the strategies above, you may be asking:

"Can my current supplier actually deliver this level of color control?"

"How do I find a manufacturing partner who understands these business risks?"

"Is it realistic to expect LED bin control and batch consistency from an OEM factory?"

These are the right questions.

Because understanding color strategy is one thing having the manufacturing capability to execute it is another.

7.1. The Gap Between Strategy and Execution

Many wholesale distributors face this challenge:

They understand what they need:

- Consistent color temperature across batches

- Flexible color options for different markets

- Small-batch testing capability

- RGB designs that minimize return rates

- Documentation for commercial projects

But their suppliers can’t deliver:

- "Color may vary slightly between batches" (no bin control)

- "Minimum order 5,000 units for any color" (no flexibility)

- "We don’t test color temperature" (no quality control)

- "RGB is RGB, we can’t customize modes" (no design optimization)

This gap creates:

- Higher return rates than expected

- Inconsistent repeat orders

- Lost commercial project opportunities

- Inventory risk from untested color variants

- Brand reputation damage

The result: Even with the right strategy, execution fails.

7.2. What Professional Color Management Requires

To execute the strategies outlined in this report, your OEM partner needs:

1. Technical Capability

✅ LED Bin Control System

- Ability to specify and control LED bins

- Color temperature tolerance: 100K or tighter

-

Batch tracking and documentation

In-Line Color Testing

- Color temperature testing during production

- Not just final inspection

-

Test reports for each batch

Consistent Component Sourcing

- Stable LED supplier relationships

- Backup sourcing for supply chain resilience

- Long-term bin availability

2. Operational Flexibility

Multiple Color Temperature Options

- 2700K, 3000K, 4000K, 5000K, 6000K available

- Custom color temperature for large orders

-

Region-specific optimization

Small-Batch Testing Capability

- 500-unit MOQ for new color testing

- Not 5,000-unit minimum

-

Fast turnaround for market validation

Mixed Container Support

- Combine multiple colors in one shipment

- Flexible packaging and labeling

- Optimize shipping costs and inventory risk

3. Quality Management

Batch Consistency Guarantee

- Documented color matching for repeat orders

- Batch code tracking system

-

Consistency reports available

Sample Approval Process

- Pre-production sample approval

- Color verification before mass production

-

Clear communication and documentation

Defect Rate Tracking

- Monitor color-related quality issues

- Continuous improvement process

- Transparent reporting

4. Strategic Partnership Approach

Market-Specific Consultation

- Understand your target market

- Recommend optimal color mix

-

Share market data and insights

Risk Management Support

- Help structure inventory for seasonal colors

- Advise on RGB positioning

-

Support channel-specific strategies

Long-Term Relationship Focus

- Not just transactional

- Support business growth

- Adapt to changing market needs

7.3. Glowyard’s Color Management System

At Glowyard, we’ve built our manufacturing process specifically to support the strategies outlined in this report.

Here’s how we deliver:

7.3.1. LED Bin Control & Consistency

What we do:

- Source LEDs with controlled bin selection

- Maintain ±100K color temperature tolerance

- Track batch codes for every production run

- Provide color consistency documentation

Learn more about our quality control systems.

What this means for you:

- Repeat orders match previous shipments

- Commercial projects meet professional standards

- Customer confidence in reordering

- Brand reputation protection

Real example:

A US distributor orders 2,000 units of 3000K warm white in March. They reorder 3,000 units in August. Our batch tracking ensures the August shipment matches the March color exactly no customer complaints about mismatch.

7.3.2 Flexible Color Options & Testing

What we do:

- Offer 2700K, 3000K, 4000K, 5000K, 6000K as standard

- Support 500-unit MOQ for new color testing

- Enable mixed containers (multiple colors in one shipment)

- Fast turnaround: 3–4 weeks for test batches

Explore our OEM customization solutions.

What this means for you:

- Test new colors without heavy inventory commitment

- Optimize for different regional markets

- Reduce risk when entering new channels

- Scale quickly when test succeeds

Real example:

A Middle East distributor wants to test 5500K cool white for their market. We produce 500 units for testing. After successful market validation, they scale to 5,000 units in the next order without risking large inventory on an untested color.

7.3.3. RGB Design Optimization

What we do:

- Simplified mode design (5 modes, not 15)

- Memory function integration (remembers last setting)

- Battery capacity optimized for RGB power consumption

- Clear user instructions and video demonstrations

What this means for you:

- Lower return rates (target: under 8%)

- Fewer "doesn’t work as expected" complaints

- Reduced customer support burden

- Better review ratings

Real example:

Standard RGB solar lights have 1012% return rates. Our optimized RGB design achieves 68% return rates for Amazon sellers a 3040% reduction in return cost.

7.3.4. Quality Control & Documentation

What we do:

- In-line color temperature testing (not just final inspection)

- Sample approval before mass production

- Batch consistency reports provided

- Defect rate tracking and continuous improvement

Visit our factory capabilities page and manufacturing equipment.

What this means for you:

- Confidence in product quality before shipment

- Documentation for commercial project requirements

- Transparent communication

- Predictable quality standards

Real example:

A landscape contractor needs 200 units for a hotel project. We provide:

- Pre-production sample approval

- Color temperature test report (3000K 80K)

- Batch consistency documentation

- Installation support

The project installs successfully with no color mismatch issues.

7.3.5. Strategic Consultation

What we do:

- Analyze your target market and channel

- Recommend optimal color mix based on data

- Share market insights and trends

- Support inventory structure planning

Check our purchasing tips for wholesale buyers.

What this means for you:

- Not just buying products getting strategic guidance

- Reduce risk through informed decisions

- Learn from our experience with other markets

- Optimize portfolio for profitability

Real example:

A new Amazon seller asks: "Should I offer 5 color options?"

Our recommendation: Start with 80% warm white, 20% RGB seasonal. Test market response for 23 months. Expand only if data supports it.

Result: Simplified inventory, better cash flow, 4.3-star average rating.

7.4. Why This Matters for Your Business

Most factories can make solar lights.

Few factories can support your color strategy.

The difference is:

Transactional suppliers say:

- "Here’s our product catalog"

- "Choose what you want"

- "MOQ is 5,000 units"

- "Color may vary slightly"

Strategic partners say:

- "What’s your target market?"

- "Let’s structure your color mix for optimal turnover"

- "We can test 500 units first"

- "We guarantee batch consistency"

At Glowyard, we’re the second type.

We don’t just manufacture solar lights.

We help wholesale buyers build sustainable, profitable product portfolios.

7.5. What Happens Next?

If the strategies in this report resonate with your business needs, here’s how we can help:

Step 1: Initial Consultation (Free)

Share with us:

- Your target market (North America, Europe, Middle East, Asia-Pacific)

- Your sales channel (Amazon, retail, commercial projects)

- Your current challenges (return rates, color consistency, inventory issues)

- Your order volume (current and projected)

We’ll provide:

- Market-specific color recommendations

- Portfolio structure suggestions

- Risk assessment and mitigation strategies

- Preliminary pricing and MOQ information

Step 2: Sample Testing

We’ll send:

- Color temperature samples (23 options based on your market)

- Technical documentation (color specs, test reports)

- Comparison with your current products (if applicable)

You evaluate:

- Color accuracy and consistency

- Product quality and design

- Packaging and presentation

- Fit with your market positioning

Step 3: Small-Batch Testing (5001,000 units)

Before large commitment:

- Test in your actual sales channel

- Validate market response

- Assess return rates and customer feedback

- Refine color selection if needed

Step 4: Scale & Optimize

Once validated:

- Scale to full production volumes

- Implement batch consistency tracking

- Optimize inventory structure

- Continuous improvement and support

7.5. Contact Our Engineering Team

We’re not a sales team pushing products.

We’re an engineering team helping you solve business problems.

Email: sales@glowyard.com

Website: www.glowyard.com

WhatsApp: +86 xxx xxxx xxxx

In your inquiry, please include:

- Target market (which region/country)

- Sales channel (online marketplace, retail, commercial)

- Current situation (existing products, challenges, goals)

- Order volume (current and 12-month projection)

We’ll respond within 24 hours with:

- Initial color strategy recommendations

- Sample options and pricing

- Timeline and next steps

- Answers to your specific questions

7.6. The Bottom Line

You’ve just read 8,000+ words on color strategy.

Now you need a manufacturing partner who can execute it.

That’s what we do.

We don’t just understand color strategy we’ve built our manufacturing process to support it.

LED bin control.

Batch consistency.

Flexible testing.

RGB optimization.

Strategic consultation.

If you’re serious about building a sustainable solar lighting business, let’s talk.

Professional FAQ: Solar Garden Light Color Selection for Wholesale Buyers

Q1: What is the safest color choice for wholesale distributors entering the solar garden light market?

Answer:

Warm white (2700K3000K) remains the safest foundation for most wholesale distributors, particularly those targeting residential markets in North America, Europe, and Australia.

Reasons:

- Lowest return rate (35% vs. 812% for RGB)

- Year-round demand (not seasonal)

- Highest review stability (4.0+ star average on major platforms)

- Broadest market acceptance (78% of US homeowners prefer warm-toned outdoor lighting)

- Lowest after-sales complexity (fewer technical issues)

Strategic approach:

- Start with 7080% warm white as core inventory

- Add secondary colors (cool white, amber, or RGB) only after establishing stable sales with warm white

- Test new colors in small batches (100500 units) before scaling

Data reference: Analysis of top 100 best-selling solar garden lights on Amazon US shows 68% are warm white, with the highest average review ratings and lowest return rates.

Q2: Why do RGB solar lights have higher return rates than single-color models?

Answer:

RGB solar lights have 23 higher return rates (812% vs. 35%) due to:

1. Operational Complexity:

- Multiple modes confuse users

- Remote control pairing issues

- Mode memory problems ("doesn’t stay on the color I want")

2. Technical Complexity:

- More components = higher failure risk

- RGB driver boards more sensitive to moisture and temperature

- Battery drain faster in color-changing modes

3. Expectation Mismatch:

- Customers expect "bright" but RGB modes often appear dimmer than single-color

- Photos show vibrant colors, but real-life installation may appear less saturated

- "Not bright enough" is the most common RGB complaint

4. User Experience Issues:

- Setup complexity leads to "doesn’t work as expected" returns

- Remote control failures create frustration

- Lack of clear instructions increases support burden

Data reference: Internal data from multiple Amazon solar light sellers shows RGB models generate 1520% support ticket rate vs. 58% for single-color models.

Wholesale strategy:

- Treat RGB as seasonal, event-driven SKU (not core inventory)

- Limit RGB to 1015% of total stock

- Launch in Q3 for holiday season sales

- Provide clear positioning and instructions

Q3: How important is LED bin control for wholesale orders?

Data aggregated from distributor analysis & industry standards

Answer:

LED bin control is critical for:

- Repeat orders (ensuring color matches previous shipments)

- Large installations (avoiding visible inconsistency)

- Brand reputation (perceived quality and consistency)

- Customer retention (confidence in reordering)

The problem:

Without bin control, the same "3000K" specification can vary:

- Batch 1: 2850K (warmer, more yellow)

- Batch 2: 3150K (cooler, more neutral)

- Visual difference is noticeable when installed side-by-side

Impact:

- "Color doesn’t match previous order" complaints

- Hesitation in repeat purchases

- Lost project opportunities (contractors require consistency)

- Brand reputation damage

Professional standard:

- 3-step MacAdam ellipse for commercial/project installations

- 5-step MacAdam ellipse for residential applications

- Color temperature tolerance: 100K for high-quality products

Wholesale action:

Request LED bin control documentation from suppliers

Specify color temperature tolerance in purchase orders (e.g., "3000K 100K")

Test samples from different production runs before large orders

Maintain batch records for repeat order matching

Data reference: According to ANSI C78.377 standard, professional lighting projects typically require 3-step MacAdam ellipse or tighter for color consistency.

Q4: Should I offer cool white or warm white for Middle East markets?

Answer:

For Middle East and GCC markets, cool white (5000K6500K) typically performs better than in Western markets.

Reasons:

- Cultural preference: Bright, cool-toned lighting associated with modernity and cleanliness

- Climate factor: Hot climates associate cool white with "freshness"

- Architectural influence: Modern building designs favor cool white

- Brightness perception: Cool white perceived as "higher quality" in these markets

Market data:

Regional distributor data shows approximately 60% preference for cool white vs. 40% warm white in Middle East outdoor lighting markets.

However:

- Hospitality projects (hotels, resorts) still prefer warm white

- Residential villas may prefer warm white for outdoor living areas

- Commercial buildings strongly prefer cool white

Recommended strategy:

For Middle East distributors:

- Primary: Cool white (5500K6000K) 6070%

- Secondary: Neutral white (4000K4500K) 2030%

- Limited: Warm white (2700K3000K) 10% (hospitality/residential niche)

This differs significantly from North America/Europe, where warm white dominates.

Key insight: Color strategy must be region-specific, not globally uniform.

Q5: What is the optimal color mix for an online marketplace (Amazon) portfolio?

Answer:

For Amazon and online marketplace success, the optimal structure is:

Core Foundation (7080%):

- Warm white (2700K3000K)

- Year-round demand

- Lowest return rate

- Highest review stability

- Repeat purchase foundation

Seasonal Add-On (1520%):

- RGB multi-color

- Launch in Q3 (AugustSeptember)

- Peak sales in Q4 (OctoberDecember)

- Clear seasonal positioning

- Higher margin but higher risk

Optional Test (510%):

- Cool white or amber (market-dependent)

- Small-batch testing

- Niche positioning

- Controlled inventory

Why this structure works:

- Warm white provides stable cash flow and review foundation

- RGB captures seasonal upside without year-round risk exposure

- Limited SKU count reduces inventory complexity

- Focus on review quality over feature quantity

Data reference:

Analysis of successful Amazon solar light sellers shows:

- Top performers maintain 12 core SKUs (warm white) with 4.0+ stars

- Seasonal RGB variants launched in Q3 for holiday sales

- Limited color variations (not 5+ options)

Key success factors:

Review stability (warm white foundation)

Seasonal timing (RGB in Q3Q4)

Clear positioning (don’t confuse customers with too many options)

Inventory control (avoid overstock on seasonal items)

For online marketplaces, consistency and review quality matter more than feature complexity.

Q6: How do I reduce return rates related to color issues?

Answer:

Most color-related returns are caused by expectation mismatch, not product defects.

Strategies to reduce return rates:

1. Accurate Product Descriptions:

Avoid: Generic terms like "bright white" or "warm light"

Use: Specific color temperature (e.g., "2700K warm white for cozy ambiance")

Clarify: "Creates soft, relaxing atmosphere" vs. "Bright modern illumination"

2. Real Installation Photos:

Avoid: Only studio photos with enhanced lighting

Provide: Real outdoor installation photos showing actual light effect

Include: Different times of day (dusk, night)

3. Clear Positioning:

For warm white:

- "Soft warm glow for relaxing garden ambiance"

- "Creates cozy, inviting atmosphere"

- "Perfect for residential gardens and patios"

For cool white:

- "Bright modern illumination for contemporary spaces"

- "Ideal for modern architecture and commercial landscapes"

- "High-brightness perception"

For RGB:

- "Multi-color modes for parties and special events"

- "Seasonal decoration and holiday lighting"

- "Not recommended as primary garden lighting"

4. Video Demonstrations:

Show: Actual light effect in real environment

Demonstrate: RGB mode switching and operation

Explain: How to use and what to expect

5. Manage Brightness Expectations:

- Cool white appears brighter than warm white at same lumen output

- If marketing "high brightness," use cool white or clarify "soft brightness" for warm white

- Provide lumen specifications, not just "super bright" claims

Data reference:

Sellers who implement these strategies report 3040% reduction in color-related returns and improved review ratings.

Key insight: Most returns are preventable through accurate positioning and expectation management.

Q7: What color temperature should I choose for commercial landscape projects?

Answer:

For commercial landscape projects, color choice depends on project type:

Modern Commercial Buildings:

- Recommended: Cool white (5000K6000K)

- Reason: Matches modern architectural aesthetic

- Priority: Brightness perception and contemporary feel

Hospitality (Hotels, Resorts):

- Recommended: Warm white (2700K3000K)

- Reason: Creates welcoming, relaxing atmosphere

- Priority: Guest comfort and ambiance

Residential Developments:

- Recommended: Warm white (2700K3000K)

- Reason: Homeowner preference for cozy outdoor spaces

- Priority: Residential appeal and comfort

Parks & Public Spaces:

- Recommended: Warm white (3000K) or Neutral white (4000K)

- Reason: Balance between visibility and comfort

- Priority: Safety and pleasant atmosphere

Critical Requirements for All Commercial Projects:

Strict color consistency (3-step MacAdam ellipse or tighter)

Batch documentation (enable matching for future additions)

Color temperature tolerance: 100K maximum

Avoid RGB (unless specifically requested for event spaces)

Why consistency matters:

Large installations (50200+ units) make even small color deviations visible.

A hotel installing 150 path lights will immediately notice if 50 units are slightly warmer than the other 100.

Wholesale strategy:

Offer fixed color temperature options (not "warm white range")

Provide batch consistency guarantees

Maintain batch records for future matching

Support large-volume orders with professional documentation

Commercial markets value stability and consistency over novelty.

Q8: How should I structure my inventory for seasonal RGB sales?

Answer:

RGB should be treated as a controlled seasonal SKU, not year-round core inventory.

Optimal RGB Inventory Strategy:

Timing:

- Order: JuneJuly

- Receive: August

- Launch: Late August / Early September

- Peak sales: OctoberDecember

- Clearance: January (if needed)

Inventory Allocation:

- 1015% of total inventory (not more)

- Small initial batch (test market response)

- Reorder if needed (based on early sales data)

Portfolio Structure:

Example for 10,000-unit total inventory:

- 7,000 units Warm white (70%) year-round core

- 2,000 units Secondary color (20%) market-specific

- 1,000 units RGB (10%) seasonal controlled batch

Risk Management:

Launch early (AugustSeptember) to capture full holiday season

Monitor sales velocity in first 23 weeks

Reorder only if sell-through rate is strong

Avoid over-ordering (unsold RGB sits for 69 months)

Plan clearance strategy (January discount if needed)

Financial Planning:

- Higher margin (1525% more than warm white)

- Higher risk (potential dead stock)

- Shorter sales window (34 months vs. 12 months)

Calculate break-even:

If RGB margin is 25% higher but 30% remains unsold, the net benefit may be negative.

Data reference:

Experienced distributors report RGB sales patterns:

- 6070% of annual RGB sales occur in Q4

- 2025% in Q3

- 1015% in Q1Q2 (clearance and off-season)

Key insight:

RGB is a margin opportunity, not an inventory foundation.