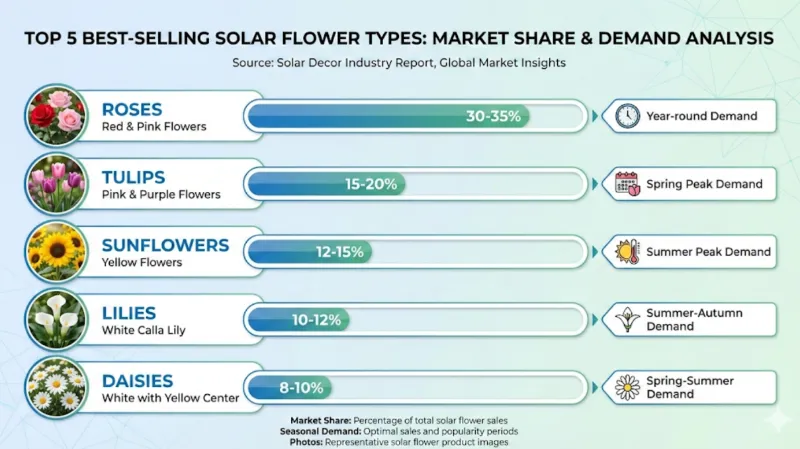

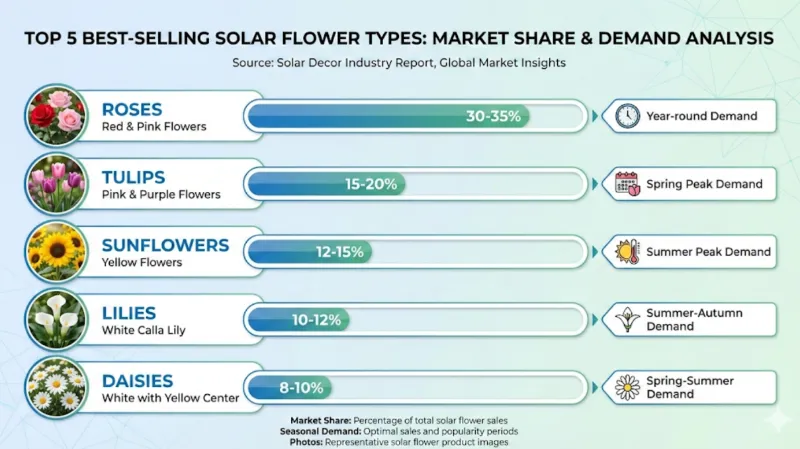

Which Flower Designs Have the Strongest Market Demand?

Market data from 15+ years of B2B exports reveals clear patterns in flower design performance across different regions and channels:

What Are the Top-Performing Flower Types for Wholesale?

- China Solar Rose Lights (30-35% of wholesale volume): Dominant across all markets with year-round demand. Red and pink variants lead sales, particularly strong for Valentine’s Day, Mother’s Day, and memorial applications. Essential for any wholesale product line.

- Tulip Designs (15-20% of wholesale volume): Highly seasonal with concentrated demand March-May. Pink and purple variants outperform other colors. Critical for spring season inventory planning.

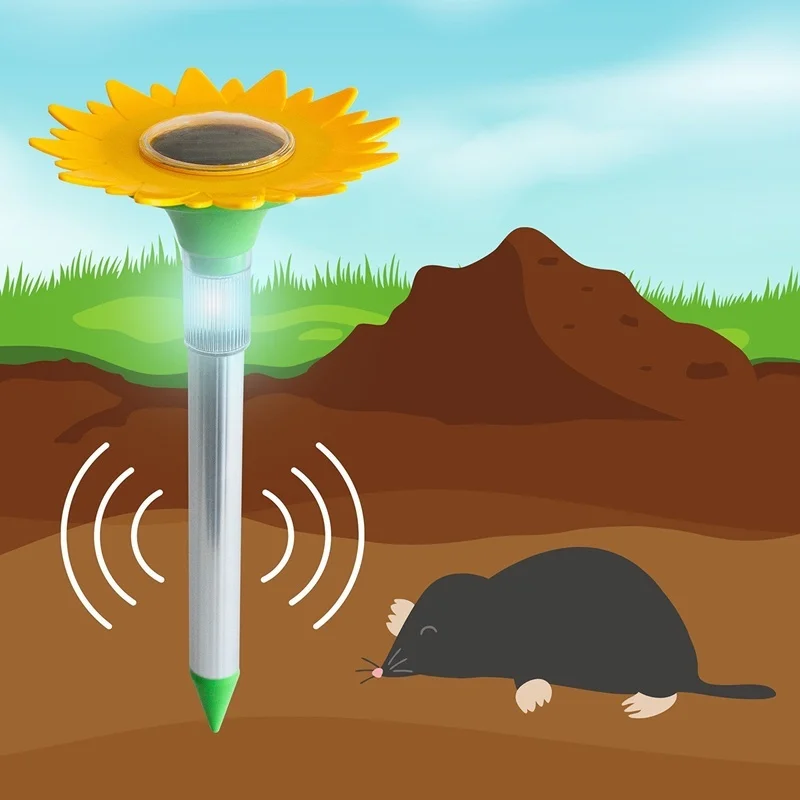

- Sunflower Designs (12-15% of wholesale volume): Summer season favorite with strong North American market appeal. Yellow classic design remains dominant, though multi-petal variations gaining traction.

- Calla Lily Solar Lights (10-12% of wholesale volume): Year-round steady demand driven by memorial and wedding markets. White variants dominate, with elegant trumpet shape providing strong differentiation.

- Daisy Designs (8-10% of wholesale volume): Budget-friendly option with broad demographic appeal. White with yellow center remains classic choice for mass market positioning.

Which Color Variants Drive the Strongest Sales?

- Red: Dominant for rose designs, essential for Valentine’s Day and memorial markets, year-round consistent demand

- Pink: Leading color for tulips and roses, strong Mother’s Day performance, broad gift market appeal

- White: Essential for lily designs, memorial market requirement, wedding and event applications

- Yellow: Standard for sunflowers and daisies, cheerful garden decoration positioning

- Purple: Growing trend particularly for tulips and orchids, appeals to premium market segments

- Multi-Color/Rainbow: Increasing demand from younger demographics and gift buyers, higher perceived value

What Flower Designs Should Wholesale Buyers Avoid?

Based on slow-moving inventory analysis from B2B distribution channels:

- ❌ Exotic Tropical Flowers: Limited consumer recognition outside specific geographic regions, slow inventory turnover

- ❌ Blue Color Variants: Unnatural appearance reduces market acceptance except in niche applications

- ❌ Oversized Designs (12+ inches): Higher cost without proportional sales increase, shipping challenges, limited display options

- ❌ Overly Complex Designs: Production costs don’t translate to sufficient retail price premium, quality control challenges

How Should Wholesalers Structure Initial Design Selection?

Recommended design allocation for first wholesale order (based on proven market performance):

- 35-40% Rose designs (red, pink, white variants) – Core demand driver

- 20-25% Tulip designs (pink, purple, mixed) – Seasonal volume opportunity

- 15-20% Sunflower designs (yellow standard) – Summer season essential

- 10-15% Lily designs (white calla lily) – Memorial and wedding markets

- 5-10% Daisy or test designs – Market testing and variety

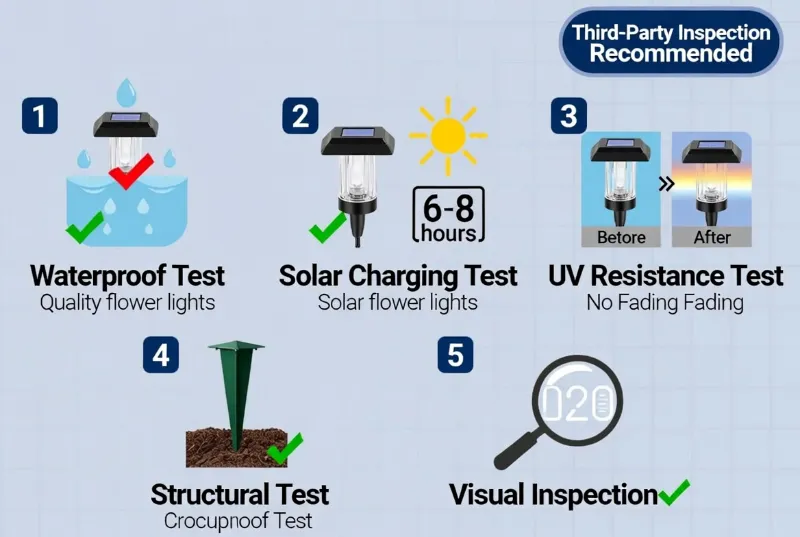

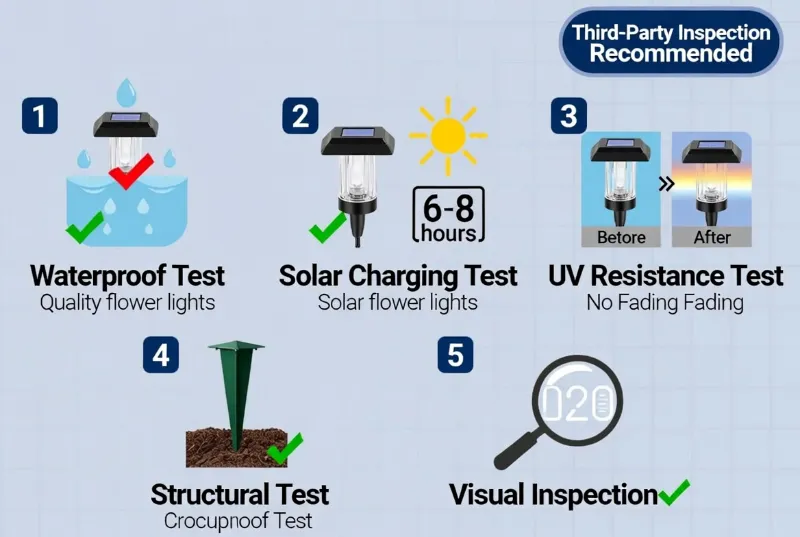

How Can B2B Buyers Verify Product Quality Before Bulk Orders?

Quality verification is critical for wholesale buyers to protect investment and maintain customer satisfaction. Implement these verification protocols:

What Sample Testing Should B2B Buyers Conduct?

Essential in-house testing protocols for sample evaluation:

- Waterproof Verification Test: Submerge complete unit in water for 24 hours minimum. Inspect for condensation inside solar panel housing or battery compartment. Any water ingress indicates inadequate sealing and should result in supplier rejection.

- Solar Charging Performance Test: Position sample in direct sunlight for 6-8 hours. Verify full charge achievement and minimum 8-10 hour runtime. Shorter runtime indicates inferior battery capacity or solar panel efficiency.

- UV Resistance Evaluation: Place samples outdoors for 2-4 weeks continuous exposure. Document any color fading or material degradation. Significant changes indicate inadequate UV stabilizers.

- Structural Integrity Test: Insert stake into soil and apply lateral pressure (15-20 lbs force). Verify no bending, cracking, or separation of components. Test connection points between flower head and stake.

- Visual Quality Inspection: Examine for paint defects, assembly gaps, visible adhesive, component misalignment, surface finish quality, and overall craftsmanship consistency.

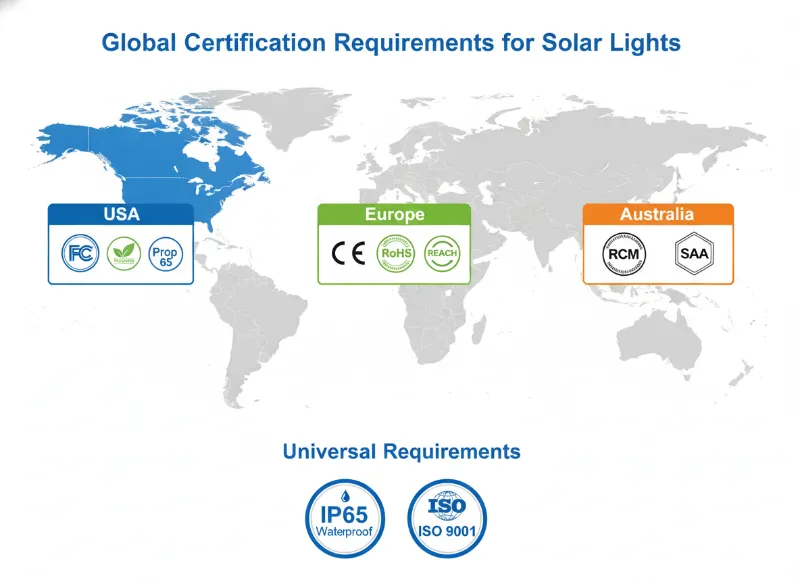

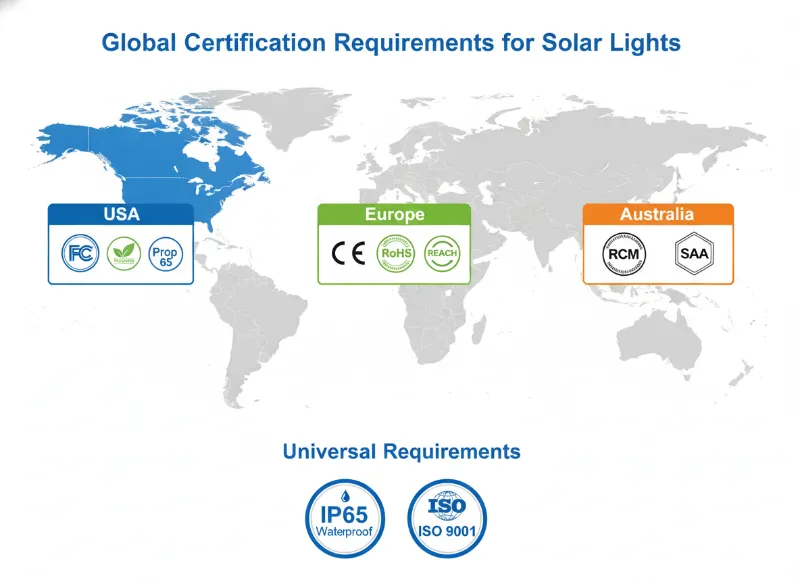

What Certifications Should B2B Buyers Require?

Market-specific certification requirements for compliance and liability protection:

- USA Market Requirements: FCC certification (electromagnetic interference compliance), California Prop 65 compliance (lead and phthalate limits), UL certification (optional but enhances credibility for premium positioning)

- European Market Requirements: CE marking (mandatory for EU distribution), RoHS directive compliance (hazardous substance restrictions), REACH regulation compliance (chemical safety documentation)

- Australian Market Requirements: RCM (Regulatory Compliance Mark) for electrical products, SAA approval for enhanced market acceptance

- Universal Requirements: IP65 waterproof rating minimum (IP67 preferred for premium products), ISO 9001 factory certification for quality management systems

How Should B2B Buyers Verify Certification Authenticity?

- Request Original Certificates: Obtain complete certificate copies, not just photos or screenshots

- Verify Certificate Numbers: Cross-reference certificate numbers on issuing authority websites (FCC database, CE marking verification portals)

- Check Expiration Dates: Ensure certificates are current and not expired (certifications require periodic renewal)

- Confirm Product Coverage: Verify certificates specifically cover the product models being sourced, not unrelated products

- Request Test Reports: Obtain detailed test reports from certified laboratories (SGS, TUV, Intertek, Bureau Veritas)

Should B2B Buyers Hire Third-Party Inspection Services?

Third-party inspection is highly recommended for:

- First Orders with New Suppliers: Verify manufacturer capabilities and quality standards before establishing relationship

- Large Volume Orders: Any order representing significant investment warrants professional inspection

- Custom or Private Label Products: Ensure specifications are met precisely for exclusive products

- New Product Launches: Verify quality before introducing products to your distribution channels

Inspection Service Options:

- Pre-Shipment Inspection (PSI): Conducted when 100% production complete, before container loading. Random sampling per AQL 2.5 standards, functionality testing, packaging verification, carton count confirmation.

- During Production Inspection (DUPRO): Conducted at 30-50% production completion. Identifies issues early when corrections are still feasible.

- Container Loading Inspection: Verifies proper loading, carton count accuracy, container condition documentation.

Recommended Inspection Companies: SGS (global leader, comprehensive services), Bureau Veritas (good balance of quality and cost), Intertek (strong in electrical product testing), AsiaInspection (cost-effective for smaller orders), V-Trust (specialized in solar products)

What Are Common Quality Issues B2B Buyers Should Monitor?

| Quality Issue | Identification Method | Prevention Strategy |

|---|

| Water Ingress | Condensation inside solar panel or battery compartment, corrosion on electrical contacts | Require IP65+ rating with certified test reports, inspect gasket quality in samples, conduct 24-hour submersion test |

| Color Fading | Plastic or paint loses vibrancy after 3-6 months outdoor exposure | Specify UV-resistant materials, request UV aging test reports (1000+ hours), conduct outdoor exposure testing |

| Stake Breakage | Plastic stakes crack or snap, especially in cold weather conditions | Specify minimum stake thickness (3-4mm), request temperature cycling test reports, test structural integrity |

| LED Failure | Lights stop functioning after 1-3 months, flickering, significantly dimmed output | Specify brand-name LEDs (Epistar, Bridgelux), require LED lifespan test reports (30,000+ hours), test runtime thoroughly |

| Battery Degradation | Runtime decreases significantly after 3-6 months use | Specify battery brand and capacity, require cycle life test reports (500+ cycles), ensure battery replaceability |

| Poor Assembly Quality | Loose connections, visible adhesive, misaligned components | Request detailed assembly process documentation, conduct pre-shipment inspection, establish clear quality standards in purchase agreement |

What Certifications and Compliance Standards Are Required?

Certification requirements vary by target market and distribution channel. B2B buyers must ensure compliance to avoid customs issues, liability exposure, and marketplace restrictions:

What Are USA Market Certification Requirements?

- FCC Certification (Federal Communications Commission): Mandatory for all electronic products sold in USA. Ensures electromagnetic interference within acceptable limits. Verify FCC ID number and test reports from accredited laboratories.

- California Proposition 65 Compliance: Restricts lead, phthalates, and other chemicals in products sold in California. Since most distributors serve California market, compliance is effectively mandatory. Request material safety data sheets (MSDS) and compliance declarations.

- UL Certification (Underwriters Laboratories): Optional but highly valued for premium product positioning. Particularly important for major retail chains and commercial installations. Significantly enhances product credibility and reduces liability concerns.

What Are European Market Certification Requirements?

- CE Marking (Conformité Européenne): Mandatory for all products sold in European Economic Area. Manufacturer’s declaration of conformity to EU health, safety, and environmental standards. Verify CE declaration of conformity and technical documentation.

- RoHS Directive (Restriction of Hazardous Substances): Restricts use of lead, mercury, cadmium, and other hazardous materials in electrical equipment. Mandatory for EU market access. Request RoHS compliance certificates and material composition reports.

- REACH Regulation (Registration, Evaluation, Authorization of Chemicals): Requires disclosure and management of chemical substances. Manufacturers must provide SVHC (Substances of Very High Concern) declarations. Critical for EU importers and distributors.

What Are Australian Market Certification Requirements?

- RCM (Regulatory Compliance Mark): Mandatory for electrical products sold in Australia and New Zealand. Replaces previous C-Tick and A-Tick marks. Verify RCM registration and compliance documentation.

- SAA Approval (Standards Australia): While not mandatory, SAA certification significantly enhances market acceptance and demonstrates commitment to Australian standards. Particularly valued by major retailers and commercial buyers.

What Universal Quality Standards Should B2B Buyers Require?

- IP Rating (Ingress Protection): IP65 minimum for outdoor solar products (dust-tight, protected against water jets). IP67 preferred for premium positioning (protected against temporary water immersion). Request IP test reports from certified laboratories.

- ISO 9001 Factory Certification: Indicates manufacturer has implemented quality management systems. While not product-specific, demonstrates organizational commitment to quality control and continuous improvement.

- BSCI or Sedex Factory Audits: Social compliance certifications increasingly required by major retailers. Demonstrates ethical manufacturing practices and supply chain responsibility.

Who Is Responsible for Certification Costs?

Standard certification responsibility allocation:

- Manufacturer Responsibility: Standard certifications (CE, RoHS, FCC) for existing product lines typically included in product cost. Manufacturer maintains certificates and provides copies to buyers.

- Buyer Responsibility: Custom products or private label may require new certifications at buyer’s expense. Market-specific certifications beyond manufacturer’s standard markets may require buyer investment.

- Negotiation Points: For large volume commitments, buyers can often negotiate manufacturer absorption of certification costs. Establish clear certification responsibility in purchase agreements.

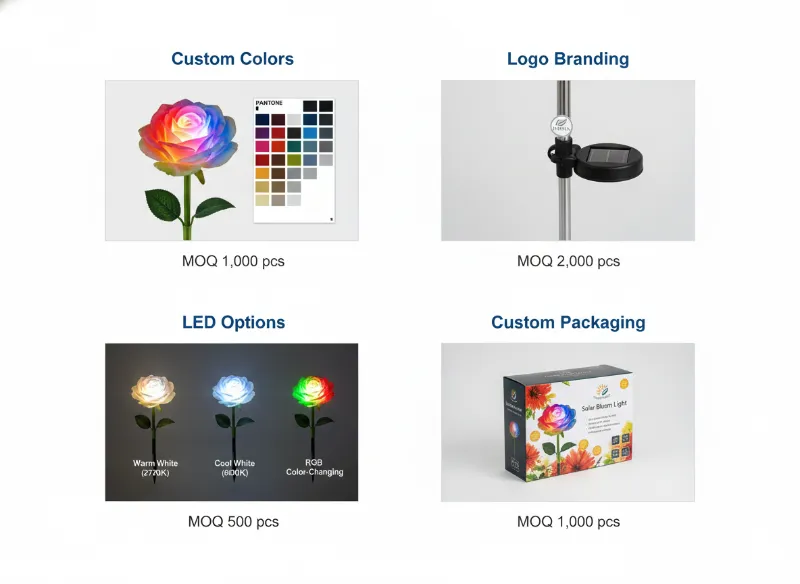

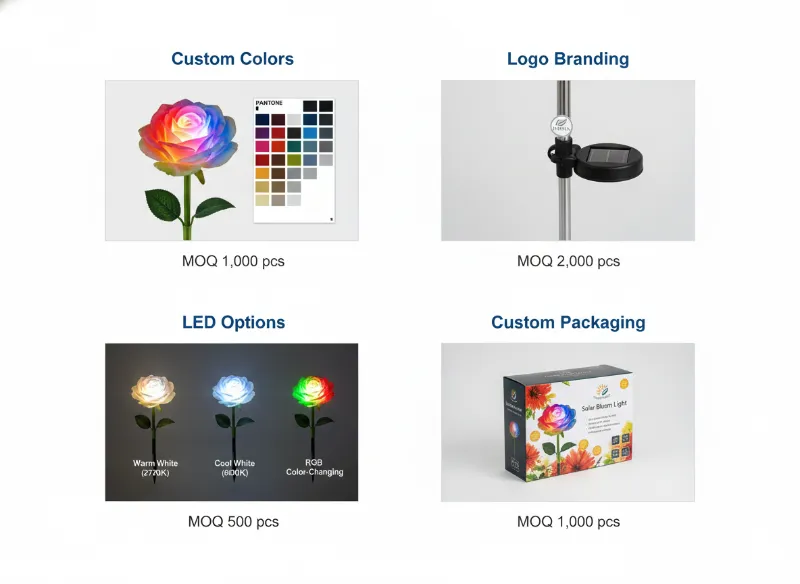

What Customization Options Are Available for Private Label?

Customization enables B2B buyers to differentiate products, build brand identity, and create exclusive market positioning. Understanding customization capabilities and requirements is essential for strategic sourcing:

What Color Customization Options Are Available?

Custom color matching for brand differentiation and market-specific preferences:

- Customization Scope: Flower petal colors, stem/stake colors, LED light colors, packaging color schemes

- MOQ Requirements: 1,000 pieces per custom color per design (for existing mold designs)

- Color Matching Process: Provide Pantone color reference or physical sample → manufacturer creates color sample → buyer approval → mass production with approved color standard

- Lead Time Impact: Additional 5-7 days beyond standard production timeline for color development and approval

- Applications: Brand-specific color schemes, seasonal exclusive colors, regional market preferences, retail chain private label programs

What Branding and Logo Options Are Available?

Brand identity integration for private label and exclusive distribution:

- Logo Placement Options: Embossed on stake (permanent, durable), printed on solar panel housing (visible, cost-effective), branded packaging (high impact, flexible)

- MOQ Requirements: 2,000-3,000 pieces for embossed logos (mold modification required), 1,000-2,000 pieces for printed logos (no mold changes)

- Branding Considerations: Logo simplicity essential for small surface areas, contrast and visibility critical for outdoor products, durability requirements for permanent branding

- Lead Time Impact: Additional 10-15 days for mold modification (embossed logos), 5-7 days for printing setup (printed logos)

- Applications: Private label programs, exclusive retail partnerships, brand building for distributors, premium positioning strategies

What LED Customization Options Are Available?

LED specifications for ambiance control and market differentiation:

- Color Temperature Options: Warm white (2700-3000K) for romantic ambiance, cool white (5500-6500K) for brighter illumination, amber for vintage aesthetic, colored LEDs (red, blue, green) for specific effects

- Advanced Options: RGB color-changing LEDs for premium positioning, twinkling/flashing effects for festive applications, brightness adjustment capabilities

- MOQ Requirements: 500 pieces for standard LED color changes, 1,000 pieces for RGB or special effects

- Market Applications: Warm white dominant for rose designs (romantic positioning), cool white for functional applications, RGB for premium gift market, colored LEDs for themed installations

What Packaging Customization Options Are Available?

Packaging customization for retail presentation and brand identity:

- Standard Packaging: Brown corrugated box with product photo label (cost-effective, functional)

- Custom Color Box: Full-color printing with brand identity, product photography, feature highlights, barcode integration (retail-ready presentation)

- Window Box: Clear window displays product, combines protection with visibility (premium retail positioning)

- Gift Box: Premium materials, decorative elements, gift-ready presentation (high-end gift market)

- Display-Ready Packaging: Hanging holes, shelf-ready design, merchandising optimization (retail chain requirements)

- MOQ Requirements: 1,000-2,000 pieces for custom packaging (printing setup costs)

What Completely Custom Design Development Is Available?

Exclusive product development for unique market positioning:

- Development Process: Concept submission and market requirements → 3D rendering and design refinement → prototype development and testing → sample approval → mold creation → mass production

- MOQ Requirements: 3,000-5,000 pieces depending on design complexity and tooling requirements

- Investment Components: Design and 3D rendering services, mold creation (buyer typically owns mold), prototype development and testing, sample production runs

- Timeline: 45-60 days from concept approval to production completion (including all development stages)

- Strategic Applications: Exclusive product lines for major retailers, proprietary designs for brand differentiation, niche market targeting, innovation leadership positioning

How Should B2B Buyers Approach Customization Strategy?

Recommended customization progression for wholesale buyers:

- Initial Orders (Market Testing Phase): Stock designs with no customization – minimize investment, test market response, establish supplier relationship, validate demand patterns

- Second Phase (Brand Building): Custom packaging and LED color selection – build brand identity, differentiate from competitors, low-risk customization, maintain inventory flexibility

- Third Phase (Market Establishment): Custom colors and logo branding – strong market differentiation, proven demand justifies investment, exclusive positioning, customer loyalty building

- Advanced Phase (Market Leadership): Completely custom designs – maximum differentiation, proprietary products, premium positioning, established distribution justifies development investment

How Should B2B Buyers Evaluate Potential Manufacturers?

Selecting the right china solar flower lights manufacturer is critical for long-term wholesale success. Implement comprehensive evaluation criteria:

What Manufacturing Capabilities Should B2B Buyers Verify?

- Product Specialization: Manufacturer should specialize in solar flower lights (not general solar products). Look for 100+ flower designs in catalog, dedicated R&D team for floral products, regular new product launches (20-30 designs annually).

- Production Capacity: Monthly capacity should exceed your projected volume needs. Verify 30,000-50,000+ units monthly capacity for established manufacturers. Confirm ability to scale for seasonal demand peaks.

- Material Capabilities: Multi-material manufacturing capability (plastic, fabric, resin, glass) indicates versatility and expertise. In-house mold making ensures quality control and faster customization.

- Quality Control Systems: ISO 9001 certification indicates systematic quality management. In-house testing laboratory demonstrates commitment to quality verification. Defect rates below 2% indicate mature quality control processes.

What Certifications and Compliance Should B2B Buyers Require?

- Product Certifications: CE, RoHS, FCC certificates with current validity dates. IP65/IP67 test reports from certified laboratories. Market-specific certifications for target regions.

- Factory Certifications: ISO 9001 quality management system. BSCI or Sedex social compliance audits (increasingly required by major retailers). Factory audit reports available for review.

- Verification Process: Request original certificate copies (not photos). Verify certificate numbers on issuing authority websites. Confirm certificates cover specific products being sourced. Check expiration dates and renewal status.

What MOQ Flexibility Should B2B Buyers Expect?

- Stock Design MOQ: 500 pieces per design is reasonable for established manufacturers. Ability to mix multiple designs to reach MOQ threshold indicates buyer-friendly policies.

- Custom Order MOQ: 1,000-2,000 pieces for custom colors or minor modifications. 3,000-5,000 pieces for completely new designs with mold creation.

- Sample Orders: Willingness to provide samples (50-100 pieces) at reasonable terms. Sample cost credit against bulk orders demonstrates confidence in product quality.

- Red Flags: Rigid 2,000-5,000 piece minimums with no flexibility. Refusal to provide samples or unreasonable sample costs. No mixed-order capabilities.

What Communication Standards Should B2B Buyers Expect?

- Response Time: Initial inquiry response within 24 hours. Ongoing communication response within 24-48 hours. Proactive production updates without prompting.

- Language Capability: English-speaking sales team for clear communication. Technical documentation available in English. Ability to discuss specifications and requirements in detail.

- Transparency: Willingness to provide factory video tours. Open about production processes and capabilities. Honest about limitations and lead times.

- Documentation: Detailed quotations with clear specifications. Written confirmation of all agreements. Comprehensive production and shipping documentation.

What Questions Should B2B Buyers Ask Potential Manufacturers?

- “How many solar flower light designs do you currently manufacture?” (Look for 100+ designs indicating specialization)

- “What is your monthly production capacity for flower lights?” (Verify capacity exceeds your needs with buffer for growth)

- “Do you manufacture molds in-house or outsource?” (In-house indicates better control and faster customization)

- “What is your typical defect rate and how do you measure it?” (Should be below 2-3% with systematic tracking)

- “Can you provide references from B2B clients in my target market?” (Verify with actual clients about experience and reliability)

- “What is your MOQ for stock designs and custom orders?” (500-1,000 stock, 1,000-2,000 custom is reasonable)

- “Do you have in-house testing equipment and laboratory?” (Yes indicates serious quality commitment)

- “Can you provide a virtual factory tour?” (Transparency indicates confidence and legitimacy)

- “What warranty terms do you offer?” (1-2 years standard, with spare parts provision)

- “What is your experience exporting to my target market?” (Market-specific knowledge valuable for compliance and preferences)

What Are Red Flags B2B Buyers Should Watch For?

- ❌ Pricing 20-30% Below Market: Usually indicates quality compromises or hidden costs

- ❌ Vague or Evasive Answers: Inability to provide specific information about capabilities or processes

- ❌ Refusal of Factory Verification: Won’t provide factory tour or detailed facility information

- ❌ No Client References: Unable or unwilling to provide verifiable client references

- ❌ Pressure Tactics: “Order now or price increases” or other urgency-creating tactics

- ❌ Poor Communication: Slow responses, unclear English, lack of technical knowledge

- ❌ Limited Product Range: Only 10-20 designs suggests trading company rather than manufacturer

- ❌ No Certifications: Cannot provide valid certificates or test reports

What Are Typical Production and Shipping Lead Times?

Understanding complete timelines enables B2B buyers to plan inventory effectively and meet seasonal demand requirements:

What Are Standard Production Lead Times?

- Stock Designs (Existing Molds, Standard Colors): 7-15 days after deposit payment confirmation. Fastest option for urgent inventory needs or seasonal replenishment.

- Custom Colors (Existing Designs): 20-25 days after color sample approval. Includes color development, sample approval, and production run.

- New Custom Designs (New Molds Required): 35-45 days including mold creation and initial production. Mold making typically 15-20 days, followed by production run.

- Sample Orders: 7-10 days for stock design samples. Allows quality verification before bulk commitments.

What Are Standard Shipping Transit Times?

Sea Freight (standard for bulk wholesale orders):

- China to USA West Coast (Los Angeles, Seattle): 18-25 days

- China to USA East Coast (New York, Miami): 28-35 days

- China to Europe (Rotterdam, Hamburg, Felixstowe): 25-35 days

- China to Australia (Sydney, Melbourne): 18-25 days

- China to Canada (Vancouver, Toronto): 20-28 days

Air Freight (for urgent replenishment): 5-7 days transit time, but freight costs 4-6x higher than sea freight. Typically used only for urgent seasonal replenishment or high-value small shipments.

What Is the Complete Order-to-Delivery Timeline?

| Order Type | Production Time | Sea Freight Time | Total Timeline |

|---|

| Stock Designs | 7-15 days | 18-35 days | 25-50 days |

| Custom Colors | 20-25 days | 18-35 days | 38-60 days |

| New Custom Designs | 35-45 days | 18-35 days | 53-80 days |

| Air Freight (Urgent) | 7-15 days | 5-7 days | 12-22 days |

Planning Buffer: Always add 10-15 days buffer for unexpected delays (weather, customs, holidays). For seasonal products, order 90-120 days before peak demand period.

What Additional Time Should Be Allocated for Customs and Distribution?

- Customs Clearance: 2-5 days typical for standard solar products (low duty rates, straightforward classification)

- Port to Warehouse: 1-3 days for inland transportation depending on distance from port

- Receiving and Quality Check: 2-4 days for warehouse receiving, inspection, and inventory processing

- Distribution to Retail Locations: Variable depending on distribution network (1-7 days typical)

- Total Post-Arrival Time: 6-19 days from port arrival to retail-ready inventory

How Should Wholesalers Plan for Seasonal Demand Cycles?

Solar flower lights exhibit strong seasonal demand patterns. Strategic inventory planning maximizes sales and minimizes excess stock:

What Are the Primary Seasonal Demand Periods?

- Spring Season (March-May): Peak demand period driven by garden planting season, Mother’s Day gifting, outdoor living preparation. Tulip designs particularly strong. Represents 35-40% of annual wholesale volume.

- Summer Season (June-August): Sustained demand for outdoor decoration and entertaining. Sunflower designs peak. Represents 25-30% of annual wholesale volume.

- Fall Season (September-November): Moderate demand with autumn-themed products. Represents 15-20% of annual wholesale volume.

- Holiday Season (December): Gift market demand, particularly for premium and bouquet designs. Represents 10-15% of annual wholesale volume.

- Winter Season (January-February): Lowest demand period except for Valentine’s Day rose spike. Represents 5-10% of annual wholesale volume.

When Should Wholesalers Place Orders for Seasonal Peaks?

Critical ordering deadlines for seasonal inventory:

- Spring Season Orders: Place orders by December 15 – January 15 for March-May delivery. Allows time for production (25-35 days), shipping (18-35 days), customs and distribution (10-15 days).

- Mother’s Day Specific: Order by February 1 – February 15 for early May delivery. Rose and tulip designs should be prioritized.

- Summer Season Orders: Place orders by March 1 – April 1 for June-August delivery. Sunflower and bright color designs emphasized.

- Holiday Season Orders: Place orders by August 1 – September 1 for November-December delivery. Earliest planning required due to factory capacity constraints during peak production season.

How Should Wholesalers Structure Seasonal Inventory Mix?

Recommended design allocation by season:

- Spring Inventory: 50% tulips (pink, purple, mixed), 30% roses (pink, red), 15% daisies and mixed flowers, 5% sunflowers (early summer transition)

- Summer Inventory: 40% sunflowers (yellow, multi-color), 30% roses (year-round demand), 20% mixed bright colors, 10% string lights (event season)

- Fall Inventory: 40% roses (memorial demand), 30% autumn-themed designs, 20% mixed flowers, 10% functional designs

- Holiday Inventory: 50% roses (red, white), 30% premium bouquet arrangements, 20% gift-ready packaging emphasis

What Year-Round Products Should Wholesalers Maintain?

Core inventory for consistent availability:

- Red Roses: Consistent demand for memorial, romantic, and gift applications. Maintain 15-20% of total inventory.

- White Lilies: Steady memorial and wedding market demand. Maintain 10-15% of total inventory.

- Mixed Color Assortments: Flexible for various customer preferences. Maintain 10-15% of total inventory.

How Should Wholesalers Manage Seasonal Transitions?

- Clearance Planning: Begin seasonal clearance 4-6 weeks before season end to minimize excess inventory

- Transition Inventory: Order next season products 8-10 weeks before season start for smooth transition

- Core Product Maintenance: Maintain year-round products at consistent levels regardless of season

- Market Testing: Use transition periods to test new designs with lower risk

What Common Sourcing Mistakes Should B2B Buyers Avoid?

Learning from common wholesale sourcing mistakes protects investment and accelerates success:

What Is the Most Critical Mistake B2B Buyers Make?

Selecting manufacturers based solely on lowest pricing without quality verification.

- The Risk: Manufacturers offering 20-30% below market pricing often compromise on materials, quality control, or certifications. Defect rates of 15-30% are common with ultra-low-cost suppliers.

- The Impact: High defect rates lead to customer returns, damaged reputation, retailer chargebacks, and potential liability issues. Total cost often exceeds savings from low initial pricing.

- The Solution: Evaluate total value including quality, reliability, service, and compliance. Always order samples and conduct third-party inspection for first orders. Build relationships with mid-tier manufacturers offering quality-price balance.

What Other Critical Mistakes Should B2B Buyers Avoid?

- Skipping Sample Verification: Sample orders are essential insurance against bulk order problems. Sample investment prevents costly quality issues and specification mismatches.

- Excessive Initial Design Range: Starting with 20-30 designs spreads inventory too thin and prevents identification of best sellers. Focus on 6-10 proven designs initially, expand based on sales data.

- Ignoring Seasonal Timing: Ordering seasonal products off-cycle results in inventory sitting for months. Plan orders 90-120 days before peak season demand.

- Inadequate Quality Specifications: Verbal agreements and vague specifications lead to disputes. Document all specifications, reference approved samples, establish clear quality standards in purchase agreements.

- Underestimating Total Costs: Focusing only on FOB pricing without accounting for freight, duties, inspection, and distribution costs. Calculate complete landed costs for accurate margin planning.

- Poor Manufacturer Communication: Vague requirements and slow responses cause misunderstandings and delays. Provide detailed specifications, respond promptly, confirm all agreements in writing.

- Avoiding Third-Party Inspection: Trusting manufacturer QC alone for first orders is high-risk. Third-party inspection provides independent verification and leverage for corrections.

- Incorrect Volume Planning: Ordering too little causes stockouts during peak demand. Ordering too much creates excess inventory and cash flow problems. Use sales velocity data and seasonal patterns for planning.

- Neglecting Packaging Quality: Poor packaging leads to product damage and weak retail presentation. Specify packaging requirements and verify before production.

- Ignoring Certification Requirements: Discovering certification gaps after ordering causes customs delays and marketplace restrictions. Verify all required certifications before purchase commitments.

What Best Practices Should B2B Buyers Follow?

- ✓ Start Small and Scale: Initial orders of 500-1,000 units minimize risk while testing market response

- ✓ Always Verify Quality: Order samples, conduct testing, use third-party inspection for first orders

- ✓ Document Everything: Written specifications, quality standards, delivery terms, warranty provisions

- ✓ Plan Seasonally: Order 90-120 days before peak demand, maintain year-round core products

- ✓ Build Relationships: Long-term manufacturer partnerships yield better service, flexibility, and terms

- ✓ Focus on Value: Balance quality, service, compliance, and pricing rather than lowest cost alone

- ✓ Verify Certifications: Confirm all required certifications before ordering, verify authenticity

- ✓ Calculate Total Costs: Include all costs (freight, duties, inspection, distribution) in planning

Partner with Glowyard for Your China Solar Flower Lights Sourcing

Glowyard Lighting specializes in manufacturing china outdoor solar flower lights for wholesale buyers, distributors, and retailers worldwide. Our comprehensive capabilities and B2B-focused approach support your business growth:

Why B2B Buyers Choose Glowyard

- ✓ Specialized Product Range: 300+ flower light designs across roses, lilies, tulips, sunflowers, and seasonal varieties

- ✓ Flexible MOQ: 500 pieces for stock designs with mixed-order capability, supporting market testing and inventory optimization

- ✓ Proven Manufacturing: 15+ years specializing in china solar powered flower lights with 50,000-80,000 units monthly capacity

- ✓ Complete Certifications: CE, RoHS, FCC, ISO9001, BSCI certified with all test reports available

- ✓ Quality Assurance: In-house testing laboratory, defect rates below 2%, 1-year warranty with spare parts provision

- ✓ Customization Capabilities: Custom colors, logo branding, LED specifications, packaging design, exclusive product development

- ✓ Fast Sampling: 7-10 days for stock design samples, sample cost credit on bulk orders

- ✓ B2B Support: Dedicated account management, seasonal planning assistance, market insights, English-speaking team

- ✓ Global Experience: Serving 500+ B2B clients across 40+ countries with proven export expertise

Start Your Sourcing Partnership

Contact our B2B team to discuss your wholesale requirements, request product samples, or schedule a virtual factory tour.

A comprehensive resource for wholesale buyers, distributors, and retailers sourcing china solar flower lights. This guide answers critical questions about product specifications, quality verification, MOQ requirements, customization capabilities, and selecting the right china solar flower lights manufacturer for your business needs.

A comprehensive resource for wholesale buyers, distributors, and retailers sourcing china solar flower lights. This guide answers critical questions about product specifications, quality verification, MOQ requirements, customization capabilities, and selecting the right china solar flower lights manufacturer for your business needs.