Decorative Solar Garden Lights SHAPES Market Analysis (2023–2026)

Decorative solar garden lights are no longer impulse add-ons in the outdoor lighting category. In many retail and online channels, they function as traffic-driving SKUs — products that create emotional engagement, increase basket value, and differentiate private labels from price-only competitors.

However, in the decorative segment, shape selection determines more than aesthetics. It influences:

- Shipment stability

- Return rate exposure

- MOQ flexibility

- Mold investment recovery speed

- Channel compatibility

- Long-term SKU lifecycle

For B2B buyers, choosing the wrong shape category does not simply mean slower sales. It often results in:

- Excess inventory

- Higher breakage rates

- Margin erosion due to after-sales handling

- Seasonal overexposure

- Unrecoverable tooling investment

This report analyzes decorative solar garden light shapes from a manufacturing, logistics, and profitability perspective, rather than purely design preference — helping different levels of buyers build a lower-risk, scalable shape strategy.

Part 1: Why Shape Strategy Determines Your Profit Structure

In the decorative solar garden lights segment, shape is not just a design element — it directly influences:

- Shipment volume stability

- Return rate risk

- MOQ flexibility

- Mold investment efficiency

- Channel suitability

- Long-term product lifecycle

Choosing the correct shape category creates structural advantages in supply chain management. Choosing the wrong one increases operational friction at every stage.

Global Decorative Shape Shipment Distribution (2023–2025)

Based on consolidated factory shipment structures and wholesale order allocation trends across North America and Europe, decorative solar garden lights can be categorized into five primary shape families.

Estimated Shipment Share by Shape Category

| Shape Category | 2023 | 2024 | 2025 |

|---|---|---|---|

| Animal Shapes | 34% | 37% | 39% |

| Floral / Nature | 22% | 21% | 20% |

| Fantasy / Story (Fairy, Gnome) | 16% | 18% | 19% |

| Modern Geometric | 18% | 15% | 13% |

| Seasonal Character | 10% | 9% | 9% |

Key Market Observations

1. Animal Shapes Continue to Grow

Animal-themed decorative lights remain the most stable and scalable category. Owl, squirrel, frog, and bird silhouettes perform consistently across retail chains and online marketplaces.

Growth drivers:

- Emotional appeal

- Gift suitability

- Low consumer explanation cost

- Broad regional compatibility

2. Floral Shapes Remain Stable but Slightly Declining

Metal-stem sunflowers, butterflies, and dandelion styles are highly visual but face:

- Higher bending risk during shipping

- Outdoor durability concerns

- Slight trend fatigue in some regions

They remain strong in garden centers and curated decorative assortments. For buyers concerned about material durability, our guide on Resin vs Iron vs Plastic vs Glass provides detailed comparisons.

3. Fantasy Shapes Are Recovering

Fairy houses, miniature castles, and gnome styles show steady growth due to:

- Social media exposure

- DIY garden ecosystem trends

- Story-driven landscaping themes

However, they carry higher structural complexity and paint-finish sensitivity.

4. Modern Geometric Shapes Are Stabilizing Downward

Minimal cube or sphere designs are increasingly perceived as functional lighting rather than decorative impulse products.

Shipment share declines as decorative buyers shift toward personality-driven SKUs.

5. Seasonal Character Shapes Are Highly Concentrated

Pumpkin, Christmas figures, and themed characters show stable but compressed selling windows (Q3–Q4 heavy concentration).

They are volume-driven but operationally risky for inexperienced buyers.

Structural Insight: What These Numbers Actually Mean

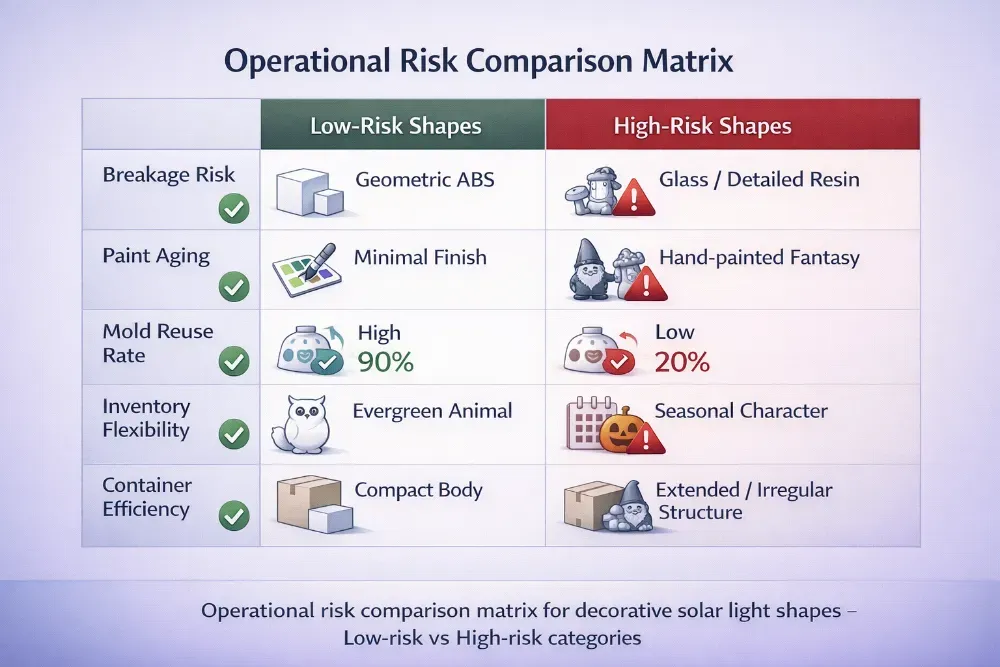

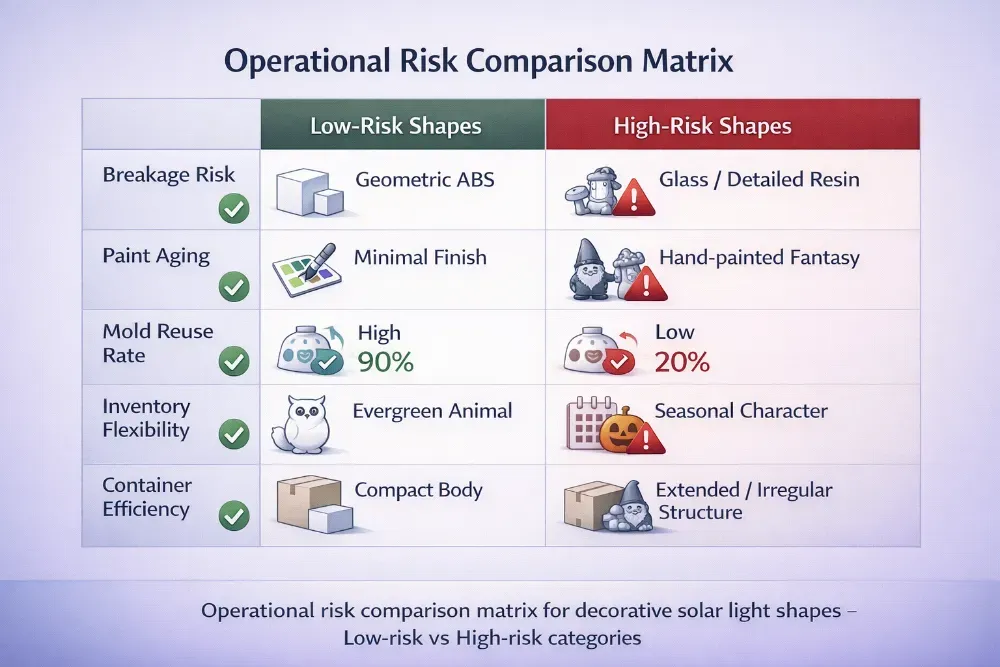

Shape selection influences five operational dimensions:

| Dimension | Low-Risk Shapes | High-Risk Shapes |

|---|---|---|

| Breakage Risk | Geometric ABS | Glass / Detailed Resin |

| Paint Aging | Minimal Finish | Hand-painted Fantasy |

| Mold Reuse Rate | High | Low |

| Inventory Flexibility | Evergreen Animal | Seasonal Character |

| Container Efficiency | Compact Body | Extended / Irregular Structure |

In decorative solar lighting, complexity amplifies operational risk.

The more sculptural and detailed the design:

- The lower the mold reuse rate

- The higher the return probability

- The larger the MOQ requirement

- The more challenging quality consistency becomes

This is why experienced distributors rarely over-concentrate in high-detail resin categories without controlled pilot testing.

Next Section Preview:

In Part 2, we will analyze:

- Return rate comparison by shape

- Relative price positioning using symbolic tiers

- MOQ difference logic

- Mold reusability ratios

- Buyer-level strategic recommendations

Continue when ready.

Part 2: Risk & Profitability Analysis by Shape Category

If Part 1 explains what is selling, Part 2 explains what is scalable and profitable.

Decorative solar garden lights differ significantly in operational risk depending on structure complexity, material composition, and production strategy. For B2B buyers, understanding these hidden variables prevents margin erosion after scale-up.

This section analyzes:

- Return rate comparison

- Relative price tier positioning (symbol-based)

- MOQ differences

- Mold reusability ratios

- Risk-adjusted category evaluation

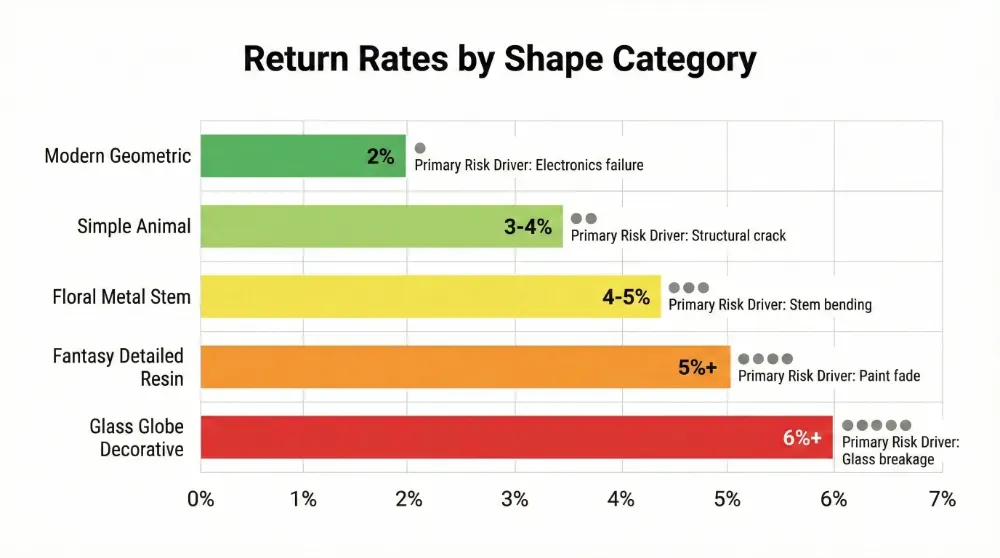

2.1. Return Rate Comparison by Shape (Operational Risk Indicator)

Return rate is one of the most underestimated profitability factors in decorative lighting.

| Shape Category | Avg Return Rate | Primary Risk Driver |

|---|---|---|

| Modern Geometric (ABS/PC) | ● Low (≈2%) | Electronics failure |

| Simple Animal (Resin/ABS) | ●● Low-Mid (≈3–4%) | Minor structural crack |

| Floral (Metal Stem) | ●●● Medium (≈4–5%) | Stem bending during transit |

| Fantasy Detailed Resin | ●●●● Mid-High (≈5%+) | Paint fade / surface crack |

| Glass Globe Decorative | ●●●●● High (6%+) | Glass breakage |

Legend:

● = Relative risk indicator (not fixed industry number)

Understanding waterproof ratings like IP44 vs IP65 vs IP67 is also critical for reducing return rates in outdoor decorative products.

Structural Insight

The more irregular and extended the structure:

- The more likely it is to absorb impact during shipment

- The more packaging reinforcement is required

- The higher the probability of cosmetic damage

Complex shapes increase both direct return rate and indirect logistics cost.

In decorative solar categories:

Shape complexity = After-sales exposure multiplier.

2.2. Relative Price Tier Distribution by Shape

Instead of fixed pricing (which varies by market), we categorize shapes into relative cost tiers:

| Shape Type | Relative Production Cost | Margin Potential | Competitive Density |

|---|---|---|---|

| Modern Geometric | $ | $ | High |

| Simple Animal | $$ | $$ | Medium-High |

| Floral Metal | $$ | $$ | Medium |

| Premium Resin Animal | $$$ | $$$ | Medium |

| Fantasy / Fairy House | $$$$ | $$$$ | Low-Medium |

| Seasonal Character | $$–$$$$ | Variable | Very High (Seasonal) |

Legend:

$ = Low relative cost

$$$$ = High relative cost

Key Observations

- Geometric shapes compete heavily on volume, not margin.

- Simple animal shapes offer balanced margin with stable demand.

- Fantasy shapes can generate high margin but require branding support.

- Seasonal characters show volatile profitability depending on timing.

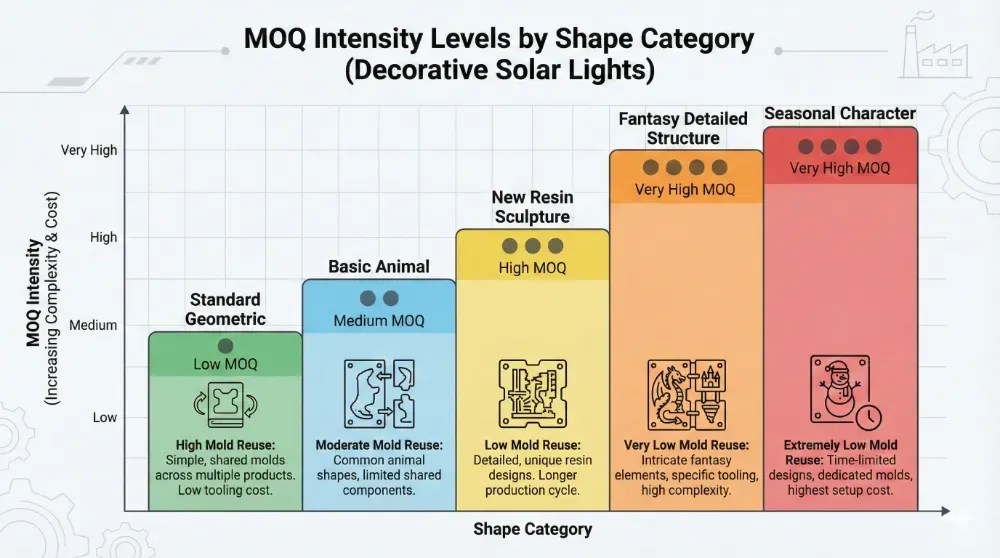

2.3. MOQ Difference by Shape Category

Minimum Order Quantity is closely linked to mold structure and finish complexity.

| Shape Type | Typical MOQ Level | Structural Reason |

|---|---|---|

| Standard Geometric (Shared Mold) | ● Low | High mold reuse |

| Basic Animal (Modified Mold) | ●● Medium | Partial structural variation |

| New Resin Sculpture | ●●● High | Dedicated sculpt mold |

| Fantasy Detailed Structure | ●●●● Very High | Complex assembly |

| Seasonal Character | ●●●● Very High | Short selling window |

Legend:

● = Relative MOQ intensity

Operational Logic

- High mold reuse = lower MOQ barrier

- Unique sculptural design = higher mold amortization requirement

- Seasonal window = aggressive volume commitment

For new buyers, MOQ flexibility often determines survival rate.

2.4. Mold Reusability Ratio (Hidden Investment Indicator)

Mold reuse rate directly affects long-term ROI.

| Shape Category | Mold Reuse Potential |

|---|---|

| Geometric | 70–80% |

| Basic Animal | 55–65% |

| Floral | 40–50% |

| Premium Resin Animal | 30–45% |

| Fantasy / Fairy House | 20–35% |

| Licensed / Seasonal IP | 15–25% |

Why This Matters

Higher mold reuse means:

- Faster development cycle

- Lower tooling amortization pressure

- Easier private label modification

- Flexible SKU expansion

Low mold reuse means:

- High upfront commitment

- Limited cross-SKU structure sharing

- Higher dead inventory risk

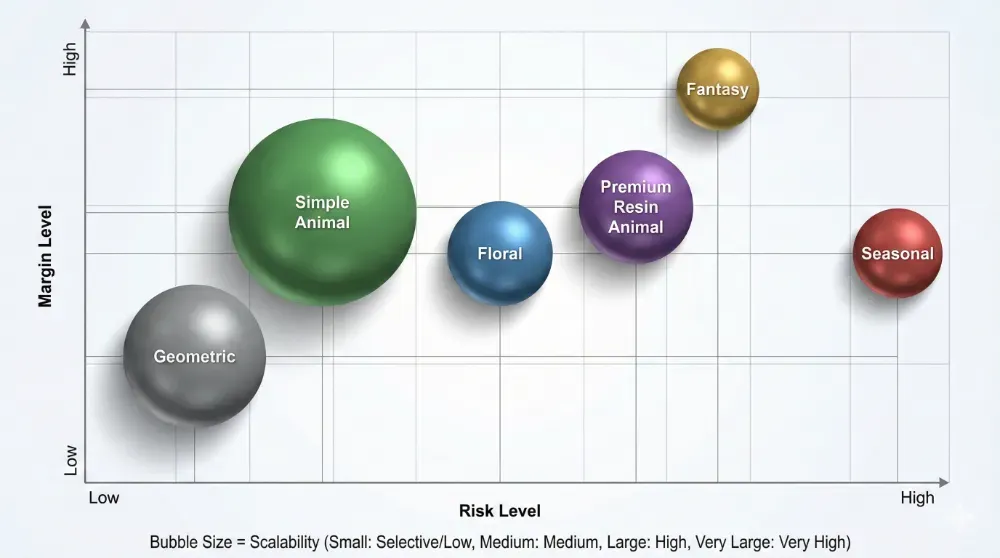

2.5. Risk-Adjusted Shape Evaluation Matrix

Combining return rate, MOQ intensity, mold reuse, and price tier:

| Shape Category | Risk Level | Margin Level | Scalability |

|---|---|---|---|

| Geometric | Low | Low | High |

| Simple Animal | Low-Medium | Medium | Very High |

| Floral | Medium | Medium | Medium |

| Premium Resin Animal | Medium | Medium-High | Medium |

| Fantasy | Medium-High | High | Selective |

| Seasonal | High | Variable | Low (Short-Term) |

Core Conclusion of Part 2

There is no universally “best” decorative shape category.

Instead:

- Low-risk buyers prioritize geometric and simple animals.

- Growth-focused sellers diversify into premium animal lines.

- Brand-driven players leverage fantasy and storytelling designs.

- Seasonal categories should only supplement, not dominate, assortments.

Next Section Preview:

Part 3 will cover:

- Recommended shape strategies for different seller levels

- Entry-level roadmap for new market entrants

- Scaling framework for mid-size distributors

- Portfolio optimization for mature brands

Continue when ready.

Part 3: Shape Strategy Recommendations for Different Seller Levels

Not all buyers should follow the same decorative shape strategy.

In fact, most profitability issues in the decorative solar segment occur when:

- New sellers start with high-risk fantasy molds

- Mid-level distributors over-invest in seasonal SKUs

- Mature brands chase volume categories without margin control

This section provides structured recommendations by seller maturity level, helping you build a scalable decorative portfolio.

3.1. New Market Entrants (Testing Phase Sellers)

Profile:

- First 6–18 months in decorative solar

- Limited capital flexibility

- Testing 3–10 SKUs

- Channel: Amazon / small retail / local distribution

Primary Objectives:

- Reduce inventory risk

- Control return rate

- Maintain MOQ flexibility

- Validate demand before scaling

Recommended Shape Strategy

| Priority Level | Shape Type | Why |

|---|---|---|

| ✔✔✔ | Simple Animal (Shared Structure) | Balanced demand + moderate differentiation |

| ✔✔ | Basic Geometric Decorative | Very low return risk |

| ✔ | Limited Floral | Visual appeal without high sculpt cost |

| ✖ | Fantasy / Fairy House | High tooling + paint sensitivity |

| ✖ | Seasonal Character | Short lifecycle risk |

Suggested Portfolio Allocation

- 50–60% Simple Animal

- 25–30% Geometric

- 10–15% Floral

- 0–10% Controlled experimental SKU

Why Start Here?

Simple animal shapes offer:

- Emotional appeal

- Broad regional compatibility

- Lower breakage rate

- Medium mold reuse potential

- Easier private label adaptation

For new sellers:

Stability matters more than uniqueness.

When starting out, working with an experienced solar garden lights manufacturer can help navigate MOQ requirements and quality control challenges.

2. Growing Sellers (Scaling Phase)

Profile:

- 1–3 years in market

- Established supplier relationship

- 20–50 active SKUs

- Some seasonal exposure

- Building brand identity

Primary Objectives:

- Improve margin

- Increase visual differentiation

- Build repeat customer base

- Reduce pure price competition

Recommended Shape Strategy

| Priority Level | Shape Type | Why |

|---|---|---|

| ✔✔✔ | Premium Animal Variants | Higher price tier potential |

| ✔✔ | Story-Based Fantasy (Controlled) | Differentiation driver |

| ✔✔ | Floral Series Expansion | Collection-building |

| ✔ | Limited Seasonal | Volume boost (controlled) |

| ✖ | Over-extended IP Risk Products | Licensing exposure |

Suggested Portfolio Allocation

- 40% Animal (Standard + Premium)

- 20% Fantasy (Tested models only)

- 20% Floral Series

- 10–15% Geometric

- 5–10% Seasonal

Strategic Insight

At this level:

- Differentiation becomes more important than safety.

- However, fantasy products should be tested in limited batches before full-scale rollout.

- Avoid over-concentration in hand-painted resin categories.

For sellers at this stage, understanding OEM vs ODM business models becomes increasingly important for strategic growth.

3.3. Mature Distributors / Brand Owners

Profile:

- Multi-channel presence

- Private label focus

- Tooling investment capability

- Stable annual reorder cycle

Primary Objectives:

- Portfolio segmentation

- Margin optimization

- Controlled risk exposure

- Mold ROI maximization

Recommended Shape Strategy

| Priority Level | Shape Type | Why |

|---|---|---|

| ✔✔✔ | Structured Animal Collection | Evergreen anchor category |

| ✔✔✔ | Branded Fantasy Ecosystem | Margin driver |

| ✔✔ | Limited High-Impact Seasonal | Traffic generation |

| ✔✔ | Modular Geometric Series | Volume stabilizer |

Advanced Strategy: Shape Layering Model

Tier 1 – Stability Core (40–50%)

- Animal + Modular decorative

Tier 2 – Margin Boosters (25–35%)

- Premium resin + Fantasy storytelling

Tier 3 – Seasonal Traffic (10–15%)

- Controlled Q3–Q4 exposure

Tier 4 – Innovation Test (5–10%)

- Experimental shapes

Key Advantage at This Stage

Mature buyers can leverage:

- Mold reuse strategy

- Structure-sharing platforms

- Paint finish standardization

- Collection-based marketing

At this level, shape becomes:

A portfolio engineering tool, not just a SKU choice.

Advanced buyers should also consider quality control processes and manufacturing capabilities when selecting manufacturing partners.

3.4. Quick Decision Guide by Risk Appetite

| Risk Tolerance | Recommended Starting Shape |

|---|---|

| Very Low | Geometric + Simple Animal |

| Low | Simple Animal Core |

| Medium | Animal + Floral |

| Medium-High | Animal + Fantasy |

| High | Fantasy + Seasonal |

Final Strategic Insight of Part 3

Decorative solar garden lights are not a trend-driven gamble category.

They are a portfolio-structured category.

- Animal = structural backbone

- Geometric = risk stabilizer

- Floral = visual enhancer

- Fantasy = margin amplifier

- Seasonal = traffic spike

Success depends not on choosing one shape — but on balancing them according to your stage.

Next Section Preview:

Part 4 will cover:

- 2026 shape trend outlook

- Emerging micro-trends (miniature ecosystem, textured finishes, hybrid functional-decorative designs)

- Long-term demand signals by region

- Strategic positioning opportunities

Continue when ready.

Part 4: 2026 Shape Trend Outlook & Long-Term Market Signals

The decorative solar garden lights segment is evolving — but not randomly.

While short-term trends fluctuate, structural demand patterns reveal clear signals about where shape categories are heading between 2026 and 2028.

This section analyzes:

- Emerging micro-trends

- Regional preference shifts

- Finish and material evolution

- Functional + decorative hybrid growth

- Long-term structural positioning opportunities

4.1. Emerging Shape Micro-Trends (2026 Forward)

Miniature Garden Ecosystem Expansion

Beyond standalone fairy houses, buyers are increasingly building coordinated micro-scenes:

- Fairy house + mushroom cluster

- Gnome + animal pairing

- Mini bridge + decorative lantern

- Garden story sets

This reflects a shift from “single decorative object” to:

Story-based decorative collection strategy.

Why This Matters

- Higher basket value potential

- Encourages repeat purchases

- Improves private label storytelling

- Supports modular SKU expansion

However:

- Paint consistency control becomes critical

- Packaging protection complexity increases

4.2 Textured & Natural Finishes Rising

Smooth plastic surfaces are slowly declining in decorative segments.

Growing demand for:

- Stone-texture resin

- Weathered bronze effect

- Rustic wood-tone finishes

- Matte earthy colors

Consumers increasingly prefer:

“Natural-looking outdoor decor” over glossy novelty items.

This trend favors:

- Resin animal

- Textured fantasy

- Rustic lantern styles

It weakens overly shiny ABS decorative pieces. For more insights on material selection, see our comparison of Resin vs Iron vs Plastic vs Glass.

4.3 Compact Decorative Lights for Smaller Gardens

Urban backyard sizes are decreasing in North America and Europe.

Demand is growing for:

- Smaller footprint animal lights

- Low-height decorative stakes

- Compact fairy accents

- Clusterable mini decorative sets

Large, bulky sculptures are seeing slower reorder rates in dense urban regions.

4.4 Hybrid Functional + Decorative Shapes

The line between decorative and functional lighting is blending.

Examples:

- Decorative owl with 360° light output

- Fairy house with pathway glow base

- Animal stake with directional accent beam

- Lantern-style decorative bollards

Buyers increasingly seek:

Aesthetic differentiation without sacrificing light performance.

This hybrid segment is projected to grow steadily through 2027.

4.5. Regional Shape Preference Shifts

North America

Strong categories:

- Animal (evergreen)

- Fantasy ecosystem

- Seasonal characters

Growing:

- Textured rustic resin

- Story-driven garden decor

Declining:

- Pure minimalist decorative shapes

For North American buyers, exploring specialized categories like Halloween solar lights can provide seasonal revenue opportunities.

Europe

Strong categories:

- Natural animal silhouettes

- Subtle floral

- Rustic lantern style

Growing:

- Compact decorative pieces

- Matte textured finishes

Declining:

- Overly colorful fantasy resin

Middle East

Strong categories:

- Gold / bronze decorative finishes

- Lantern-based shapes

- Premium resin animals

Growing:

- Statement decorative pieces

Asia-Pacific

Strong categories:

- Small-scale animal

- Cute mini fantasy

- Giftable decorative lights

Growing:

- Multi-color decorative accents

- Compact garden ornaments

4.6. Long-Term Structural Signals (2026–2028)

Based on shipment pattern evolution and buyer behavior, five signals stand out:

Signal 1: Evergreen Animal Dominance Will Continue

Animal shapes are not a trend category.

They are an emotional anchor category.

Expect:

- Continued gradual growth

- Higher segmentation (basic vs premium finish)

- Expansion into coordinated sets

Signal 2: High-Detail Fantasy Will Polarize

The fantasy segment will split into:

- High-quality, story-driven premium SKUs

- Low-cost novelty versions with short lifecycle

Mid-level generic fantasy may struggle.

Signal 3: Seasonal Concentration Will Intensify

Retailers are becoming more cautious with seasonal risk.

Expect:

- Larger but fewer seasonal SKUs

- Stronger pre-booking requirements

- Higher MOQ thresholds

Seasonal will remain profitable — but capital intensive.

Signal 4: Mold Platform Strategy Will Gain Importance

Buyers increasingly prefer:

- Platform-based structural reuse

- Shared internal battery modules

- Modular LED system integration

Mold reuse ratio will become a strategic advantage. Understanding OEM customization processes helps buyers maximize mold investment efficiency.

Signal 5: Decorative ≠ Fragile Anymore

Shipping cost pressure forces:

- Reduced glass usage

- Impact-resistant resin

- Reinforced internal housing

Future decorative shapes must balance beauty with durability.

4.7. Strategic Positioning Opportunities for Buyers

If entering or expanding in 2026:

Safe Expansion Path

- Strengthen animal collection

- Add compact fantasy subset

- Introduce 1–2 rustic textured SKUs

Growth-Oriented Path

- Develop story-based micro-collections

- Invest in platform mold sharing

- Differentiate finish quality

High-Margin Strategy

- Focus on premium resin detail

- Limit SKU count

- Increase perceived craftsmanship

Final Insight

The decorative solar garden lights market is not driven by chaos.

It is shaped by:

- Emotional buying behavior

- Logistics efficiency constraints

- Mold amortization logic

- Channel differentiation pressure

In 2026 and beyond, success will not come from chasing the newest shape.

It will come from:

Structuring your decorative portfolio around stability, margin, and controlled innovation.

For buyers ready to implement these strategies, partnering with an experienced decorative solar garden lights manufacturer provides the foundation for long-term success.